Are you eager to learn how to start crypto trading as a beginner? Great, let’s get to it.

The reality is that trading cryptocurrencies and making a profit aren’t easy. You can’t just jump in without any knowledge.

To have a shot at success in crypto trading, you need proper guidance, and that’s exactly what I’m here to offer.

In this comprehensive guide, I’ll outline everything you need to start your crypto trading journey.

I’ll also share some tips and tricks to give you the knowledge you need to succeed in crypto trading, even if you’re starting from scratch.

IMPORTANT: I've selected some really great blog posts that I think you'll absolutely love. They're waiting for you right at the bottom of this post. Don't forget to give them a read!What is Crypto Trading?

Crypto trading is the process of buying and selling cryptocurrencies like Bitcoin and Ethereum. Traders aim to profit by predicting whether these cryptocurrencies will go up or down in value.

They use various strategies and tools to buy at a low price and sell at a higher one.

The market can be very unpredictable, and prices can change quickly, which makes crypto trading both exciting and risky.

Unlike traditional stock markets, cryptocurrency markets operate 24/7, allowing traders to trade at any time.

Investing vs. Trading:

- Investing: Holding cryptocurrencies long-term, for months or years, anticipating that their value will rise over time.

- Trading: Short-term buying and selling within hours, days or weeks, aiming to profit from market fluctuations.

Getting Started with Crypto Trading as a Beginner

Before getting into how to start trading crypto, there are a few important things you need to know and do first.

1. Choosing the Right Exchange

The first step is to select a reliable crypto exchange where you can buy, sell and trade cryptocurrencies.

Think of an exchange as the marketplace where all the action happens.

But with so many crypto exchanges to choose from, you should always go for the best. These include Binance, Bybit, and Gate.io.

You can also read this post to learn how to Choose a Reliable Crypto Exchange.

2. Creating Your Crypto Exchange Account

Once you’ve chosen an exchange, the next step is to create an account.

Here’s a simple guide to get you started:

- Sign Up: Go to the exchange’s website and click on the sign-up or register button.

- Provide Information: You’ll need to provide some basic information such as your email address, password, and sometimes a phone number.

- Verify Your Email: Check your email for a verification link from the exchange. Click on this link to verify your email address.

- Identity Verification: Most exchanges require you to complete a KYC (Know Your Customer) process. This involves providing a government-issued ID and sometimes a selfie for verification. This step is crucial for security and regulatory compliance.

3. Adding Money to Your Account

Now that your account is set up, you need to deposit funds to start trading. Here’s how:

- Deposit Methods:

- Bank Transfer: Many exchanges allow you to link your bank account for direct transfers.

- Credit/Debit Card: Some exchanges let you buy cryptocurrencies directly with a credit or debit card.

- Crypto Deposit: If you already own cryptocurrency, you can transfer it to your new exchange wallet.

- Steps to Deposit Funds:

- Log In: Log in to your exchange account.

- Go to Deposit Section: Navigate to the deposit section of the exchange.

- Choose Deposit Method: Select your preferred deposit method (bank transfer, credit card, etc.).

- Follow Instructions: Follow the on-screen instructions to complete the deposit. This might include entering bank details or card information.

- Wait for Confirmation: Depending on the method, it might take some time for the funds to appear in your account. Bank transfers might take a few days, while card purchases are usually instant.

For More Details Read: How to Buy Cryptocurrencies for The First Time

4. Understand Crypto Trading Pairs

Cryptocurrency trading pairs are a fundamental concept in crypto exchanges. When you trade cryptocurrencies, you are essentially swapping one type of cryptocurrency for another.

These pairs consist of two different cryptocurrencies and are often represented with a slash, like BTC/USDT.

When you see a trading pair, the first currency listed is the base currency, and the second is the quote currency.

Understanding trading pairs is crucial because they determine what currencies you can directly exchange.

Different exchanges may offer different trading pairs, so it’s essential to check which pairs are available on the platform you are using.

For More Details Read: What Trading Pairs are in Crypto

5. Understand Market Orders and Limit Orders

When trading crypto, you’ll encounter different types of orders. Knowing what each one means will help you trade more effectively.

But here are the two you should know about when starting out as a beginner:

- Market Orders: A market order is an order to buy or sell a cryptocurrency immediately at the current market price. For example, if Bitcoin is trading at $70,000 and you place a market order, it will execute immediately at around $70,000.

- Limit Orders: A limit order is an order to buy or sell a cryptocurrency at a specific price. For example, if Bitcoin is trading at $70,000 but you only want to buy it at $68,000, you place a limit order at $68,000. The order will only be executed if the price drops to $68,000.

So, use market orders when you want to execute a trade quickly and are okay with the current price, and limit orders when you want to buy or sell at a specific price and are willing to wait for the crypto to reach that price.

6. Learn How to Read Price Charts

Reading and understanding price charts is a crucial skill for any crypto trader.

Price charts provide valuable information about the past performance and current trends of a cryptocurrency, helping you to predict where the crypto price is going next.

The most common chart is the “candlestick chart.”

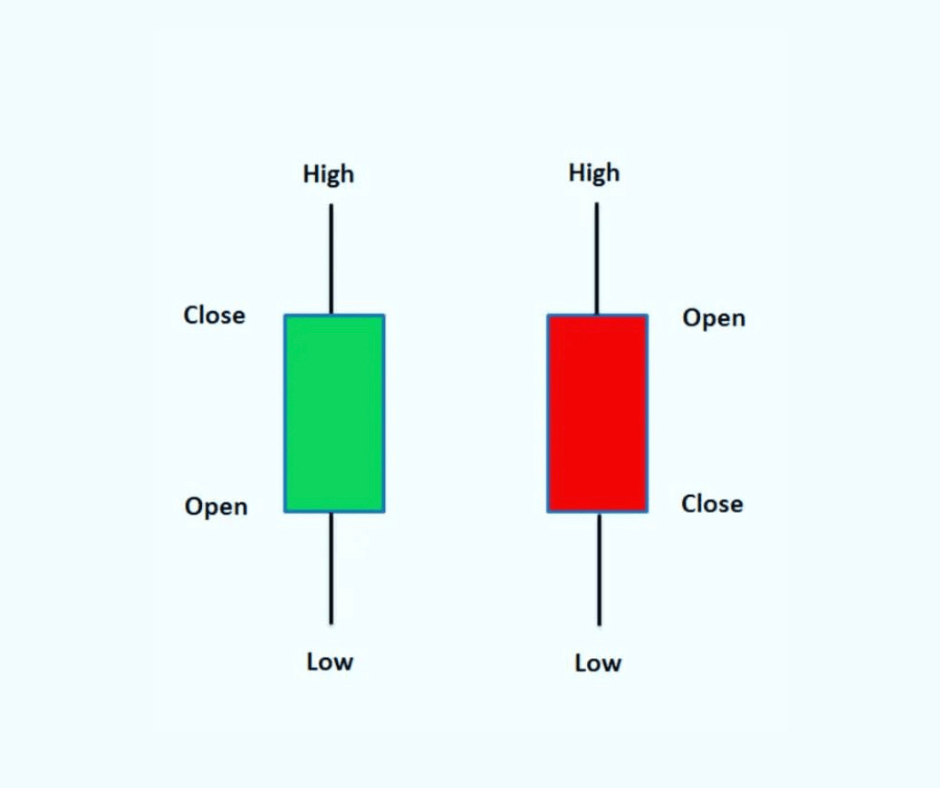

Each candlestick represents a specific period (e.g., one hour, one day) and shows the opening, closing, high, and low prices for that period.

Key Components of Candlestick Charts

Here’s a breakdown of the key components:

- The Body: The body shows the opening and closing prices for the period.

- Green (or White) Candlesticks: Indicate that the closing price is higher than the opening price (bullish).

- Red (or Black) Candlesticks: Indicate that the closing price is lower than the opening price (bearish).

- The Wick (or Shadow): The thin lines above and below the body. They show the highest and lowest prices during the period.

- Upper Wick: Shows the highest price.

- Lower Wick: Shows the lowest price.

Price charts often come with various indicators and tools to help analyze market trends.

For More Details Read: How to Read a Crypto Candlestick Chart Like a Pro

Developing a Crypto Trading Strategy

Now that you’ve got the basics of how the cryptocurrency market works, it’s time to start thinking about your own plan.

This plan will be tailored to your own goals and how comfortable you are with taking risks.

A smart strategy can help you make wise choices and avoid common mistakes when trading cryptocurrencies.

Let’s break it down step by step:

1. Deciding to HODL or Trade

Before we get into the nitty-gritty of your strategy, you need to decide if you want to be a HODLer or a trader.

Here’s what that means:

- HODLing: It’s just a silly way of saying “hold.” HODLers buy cryptocurrencies and hold onto them for a long time, hoping their value will go up over the years. It’s not very stressful, but it does require patience.

- Trading: If you’re a trader, you’re trying to make money from short-term changes in prices. You buy low and sell high, which might mean making lots of trades. This approach can be riskier, but it could also bring in quicker rewards.

2. Managing Your Risks

No matter which path you choose, you’ve got to be smart about handling risks.

Here are some important things to think about:

- Diversification: Don’t put all your money into just one type of cryptocurrency. Spread your investments across different ones to reduce your risk.

- Stop-Loss Orders: This is like setting a safety net. You tell the system to sell your cryptocurrency if its price starts to drop too much. This helps you avoid big losses.

- Risk Percentage: Decide how much of your total money you’re willing to risk on a single trade. A good rule of thumb is not to risk more than 2% of all your money on one trade.

Related:

- The Importance of Risk Management in Crypto Trading

- Understanding Stop Loss and Take Profit Orders in Crypto

3. Research and Analysis

Before you make any moves, do some research:

- Fundamental Analysis: This is like learning the background of a cryptocurrency. You study things like the technology behind it, the team involved, and what it’s used for. You also look at what could affect its value.

- Technical Analysis: This is about studying price charts and patterns. You try to spot trends, support (where prices tend not to go below), and resistance (where prices tend not to go above) levels. All of this helps you make informed decisions.

Related:

- The Role of Fundamental Analysis in Crypto Trading

- The Importance of Technical Analysis in Crypto Trading

4. Making a Trading Plan

Think of a trading plan as your GPS in the crypto world.

It should include:

- Entry and Exit Strategies: You need to decide what conditions will make you start or stop a trade. For example, you might decide to sell when you’ve made a certain amount of profit or if the price drops to a certain level.

- Risk-Reward Ratio: This is about figuring out how much you expect to make compared to how much you could lose.

- Emotional Discipline: Sticking to your plan is important. Don’t let fear or greed push you into making quick decisions that might not be smart.

As a beginner, it’s a good idea to start with a simple plan and adjust it as you learn more.

Remember, the crypto market can be very unpredictable, so never invest more than you can afford to lose.

Making Your First Crypto Trade

Congratulations on reaching this exciting milestone! You’re about to take your first step into the world of cryptocurrency trading, and we’re here to guide you through it.

Let’s get started:

1. Placing Your First Trade

So, it’s time to make your first crypto trade.

Here’s a simple, step-by-step guide:

– Login: Start by logging into your chosen crypto exchange using the credentials you set up when you created your account.

– Find the Trading Platform: Look for the ‘Trading’ or ‘Exchange’ section on the exchange’s website or app.

– Pick Your Trading Pair: Choose the two cryptocurrencies you want to trade. For beginners, it’s a good idea to start with popular pairs like Bitcoin (BTC) against US dollars (USD) or Ethereum (ETH) against US dollars (USD).

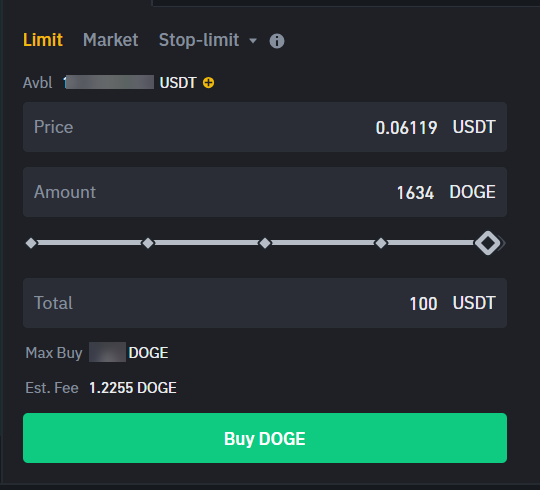

– Choose Your Order Type: You have two options here: a market order or a limit order. If you want to trade right away, go for a market order. If you prefer more control over the price, go with a limit order.

– Set the Amount: Enter how much of the crypto you want to buy or sell. Make sure this fits with your risk management plan.

– Review Your Order: Double-check everything, like the amount and order type, to make sure it’s all correct.

– Place Your Order: Once you’re happy with everything, click ‘Buy’ or ‘Sell’ to place your order. If it’s a market order, it’ll be done almost instantly at the current market price. If it’s a limit order, it will be executed when the market reaches the price you specified.

2. Monitoring Your Trade

Now that your order is in, you’ll want to keep an eye on how it’s doing.

Here’s how:

– Use the Exchange’s Portfolio or Balance Section: This is where you can see how your holdings are doing.

– Watch the Price Chart: Keep an eye on the cryptocurrency’s price to see if your trade is going up or down.

– Set Alerts: Some exchanges have a feature that lets you know when the price reaches a certain level.

Read Also: How to Get Crypto Price Alerts

3. Common Mistakes to Avoid

As a beginner, you’ll want to avoid some common blunders:

– Emotional Trading: Don’t let fear or greed push you into making hasty decisions. Stick to your plan.

– Overtrading: Don’t jump into too many trades at once. Start with a few and build your experience gradually.

– Not Managing Risks: Things like setting “stop-loss” orders (to limit your losses) and controlling the size of your trades are crucial. Protect your money at all costs.

-Chasing Hype and FOMO: FOMO, or the fear of missing out, can make you buy when prices are sky-high. Try to stay calm and enter trades at sensible prices.

– Trading Without a Plan: Trading without a clear strategy is like gambling. Always have a plan before you make a trade.

– Not Learning from Mistakes: Mistakes are part of the game. Learn from them and get better.

Remember, your first trade is a learning experience. If it doesn’t go exactly as planned, don’t be discouraged.

Learning from both successes and mistakes is all part of the journey.

As you gain more experience, you can refine your strategy and try different trading pairs.

For now, take it step by step, stay patient, and keep yourself informed about the market.

Additional Resources:

Excited to learn more about Bitcoin and cryptocurrencies? We’ve got some awesome resources below to help you out.

- How to Protect Your Cryptocurrencies From Being Stolen

- 5 Top Indicators for Successful Crypto Trading

- How to Avoid Losses in Crypto Trading

- The Importance of Backtesting in Crypto Trading

- Best Tools Successful Traders Use When Trading Crypto

- 5 Common Crypto Scams and How to Avoid Them

- The Psychology of Crypto Trading

- Understanding Support and Resistance in Crypto Trading

And guess what? We’re also on Instagram and Twitter(X). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is intended for informational purposes only and should not be solely relied upon for making investment decisions. It does not constitute financial, tax, legal, or accounting advice. Additionally, I strongly recommend that you only invest in cryptocurrency an amount you are comfortable with potentially losing temporarily.

Read Also: Safest Stablecoins to Use in Crypto Trading