Have you ever bought a coin, watched it rise, and then crashed before you could sell it? Or sold too soon, only to see it skyrocket right after?

Crypto moves fast. Without a plan, profits can vanish just as quickly as they came. On Binance, it’s easy to chase hype and forget to protect your trades. One sharp drop can drain your account. Miss a good exit, and gains turn into regret. That’s why stop loss and take profit are important.

With these tools, you don’t have to sit in front of charts all day or panic every time the market moves.

This quick guide shows how to set stop loss and take profit on Binance, step by step.

What is Stop Loss in Crypto Trading?

A stop loss is a tool that helps you protect your crypto when the market goes down. You set a price, and if your coin falls to that level, it sells automatically. For example, if you buy Bitcoin at $100,000 and set a stop loss at $98,000, your BTC will be sold when the price drops to $98,000. This way, you limit how much you lose.

With a stop loss, you don’t need to watch the crypto market 24/7.

What is Take Profit in Crypto Trading?

Take profit is a tool that helps you lock in gains when a coin’s price goes up. You set a target price, and once it hits that level, your crypto sells automatically. For example, if you buy Ethereum at $3,000 and set take profit at $3,500, your Ethereum will be sold when the price reaches $3,500. This way, you secure your gains before the market turns, all without needing to watch the market all day.

Take profit matters because crypto can rise fast, then drop just as quickly.

How to Set Stop Loss and Take Profit on Binance

Setting a stop loss and take profit on Binance is a smart way to manage your crypto trades. The best part? You don’t need two separate orders. Binance offers a tool called OCO (One Cancels the Other), which lets you set both at the same time.

Here’s how to do it step by step:

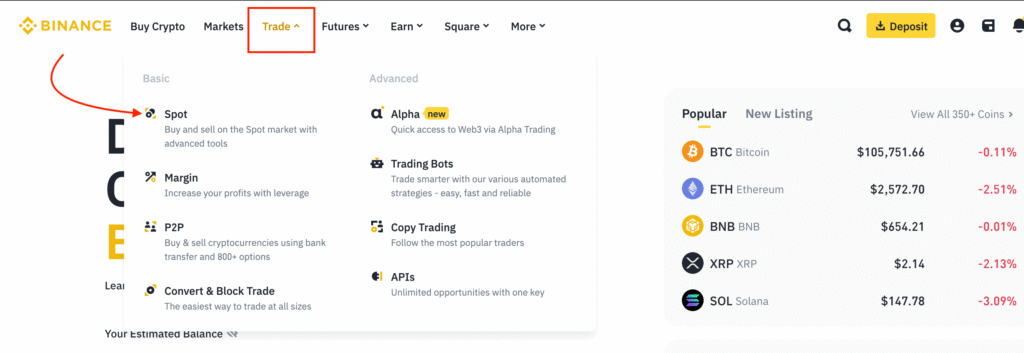

1. Log in to your Binance account

Make sure you’re on the “Spot” trading page, where you can buy and sell crypto. If you don’t already have a Binance account, sign up here to get discounts on trading fees.

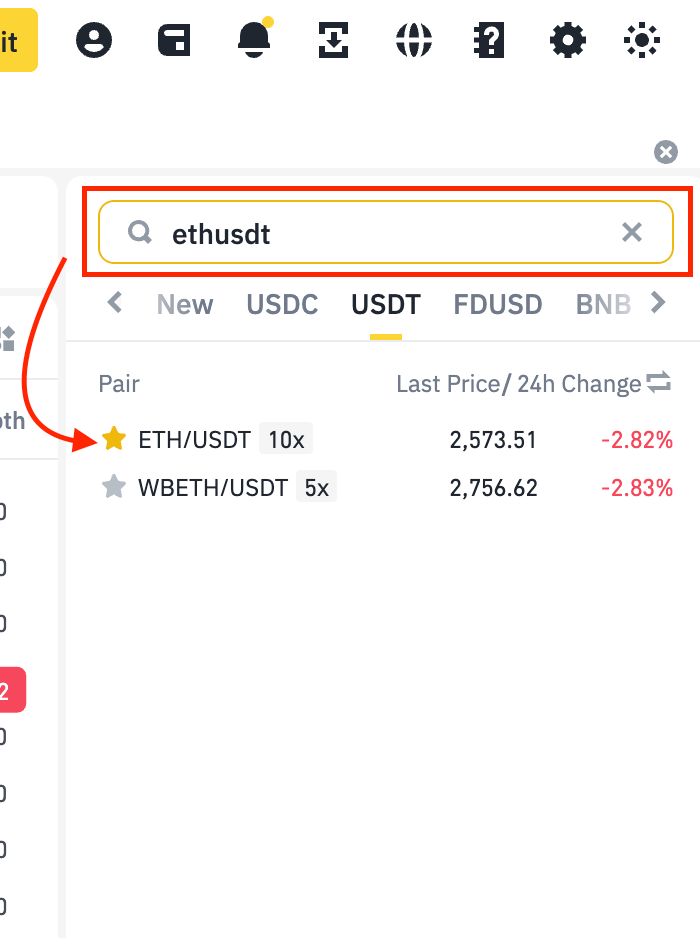

2. Choose the trading pair you want to trade

For example, if you’re selling Ethereum for USDT, select ETH/USDT.

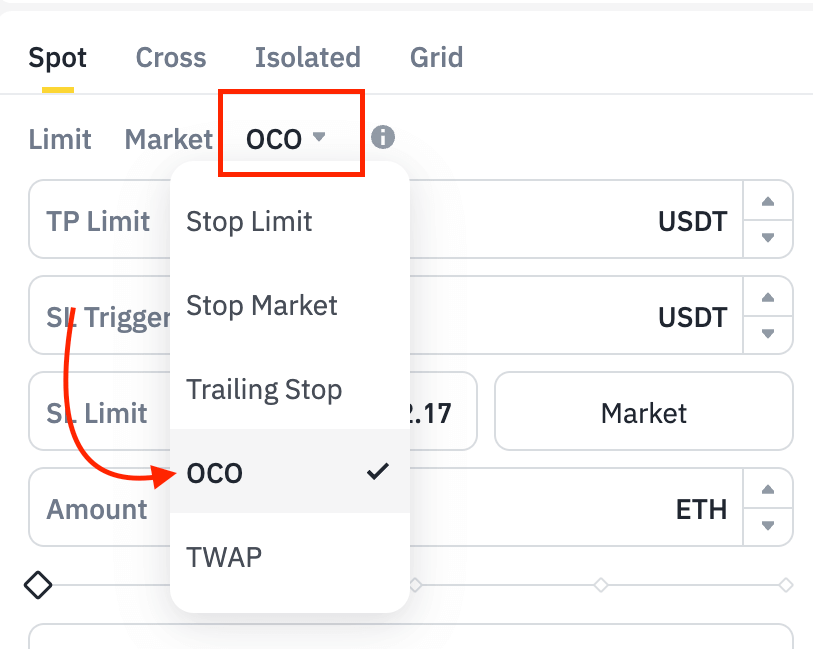

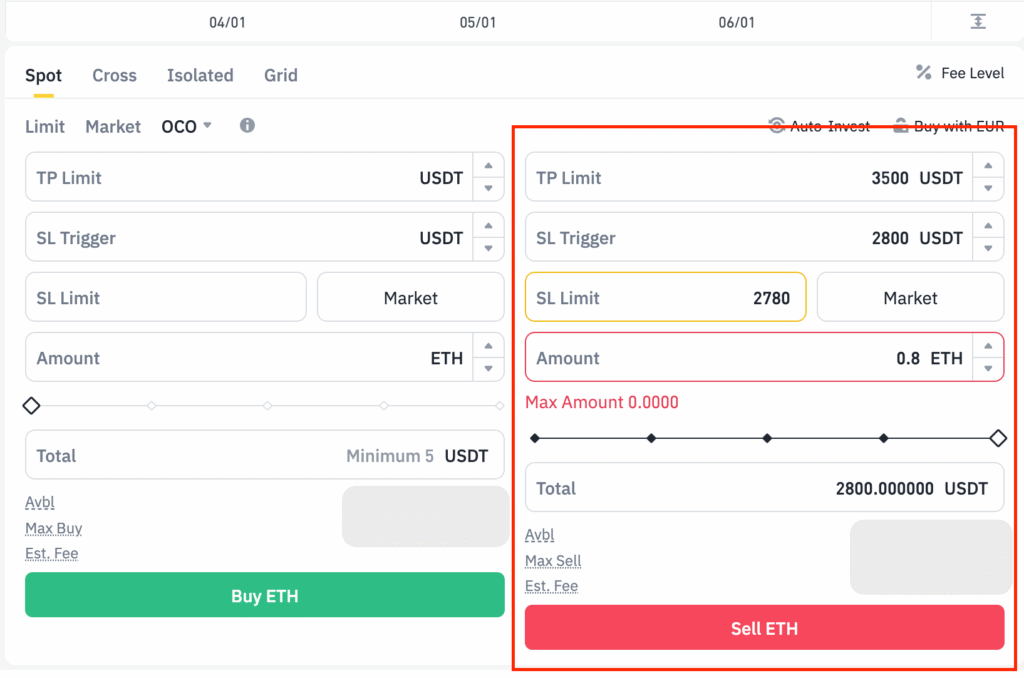

3. Scroll to the trading box and click “OCO”

Below the chart, find the order box and click the OCO tab. This lets you set stop loss and take profit in one order.

4. Enter your take profit and stop loss details

You’ll see four input boxes:

- TP Limit: This is the price where you want to take profit.

- SL Trigger: This is the price that triggers the stop loss.

- SL Limit: This is the price at which your stop loss order will sell. Set it slightly below the trigger. To sell faster during drops, you can select “Market” to skip the limit.

- Amount: The amount of crypto you want to sell.

For example:

Let’s say you bought Ethereum at $3,000. You want to take profit at $3,500 and set a stop loss at $2,800.

Here’s what you would enter:

- TP Limit: 3,500

- SL Trigger: 2,800

- SL Limit: 2,780

- Amount: 0.8 ETH

This means:

If Ethereum hits $3,500, it will sell and secure your profit.

If it falls to $2,800, Binance will sell it at $2,780 to reduce your loss.

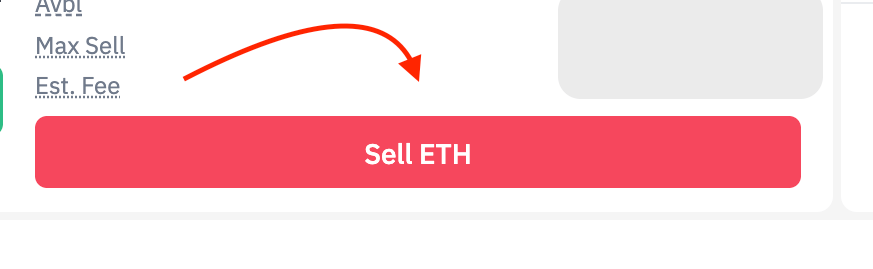

5. Click “Sell ETH” to confirm your trade

Double-check your inputs, then click Sell. Binance will now monitor the price. When one target is hit, the other gets canceled automatically.

That’s it. You’ve now protected your crypto trade and planned your profit—all in one simple step.

Smart Tips for Using Stop Loss and Take Profit

Here are a few key tips to help you get better results when setting stop loss and take profit orders:

1. Always double-check your order before confirming

Mistakes happen—mixing up numbers or using the wrong field can cost you. Before you hit confirm, take a moment to review the price, amount, and order type.

You May Like: Seven Common Mistakes Crypto Investors and Traders Make

2. Start with small amount if you’re new

If you’re new to OCO orders or trading in general, it’s better to test things with a small portion of your crypto. It’s a safer way to practice and avoid big losses. Once you’re confident, you can start using larger amounts.

3. Keep emotions out of your stop loss decisions

Once your stop loss is set, please resist the urge to change it. Market swings can trigger fear or panic, but adjusting your plan mid-trade often leads to poor decisions. Trust your setup.

4. Always have a reason behind your price targets

Avoid picking random numbers. Use charts, recent highs and lows, or support and resistance levels to guide your stop loss and take profit points. A clear strategy builds confidence and improves your results.

Additional Resources:

- 7 Best Ways You Can Secure Your Crypto From Being Stolen

- Must-Have Tools Every Crypto Trader Should Use

- Top 4 Alternatives to Binance

- 5 Best Ways to Take Profits in Crypto Without Regret

And guess what? We’re also on Instagram and X (Twitter). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is for informational purposes only. Do not rely solely on it for making investment decisions. It is not financial, tax, legal, or accounting advice. Always do your own research or consult a financial advisor before investing in cryptocurrency.