Many traders struggle with knowing when to take profits in crypto. Some hold too long, chasing bigger gains—only to lose everything in a crash. Others sell too soon out of fear, missing huge opportunities.

This cycle of greed, fear, and regret traps countless traders. Without a clear strategy, making the right decision feels impossible.

Crypto is unpredictable. Your portfolio could skyrocket 200% today, only to be wiped out by a sudden crash tomorrow. But most traders don’t fail because they can’t make money—they fail because they don’t have a plan for securing profits when they should.

So, what’s the best way to take profits in crypto?

In this guide, you’ll learn smart strategies to take profits in crypto without regret. By the end, you’ll know exactly when to sell, how much to take out, and how to avoid costly mistakes.

5 Best Ways to Take Profits in Crypto

Now, let’s get to it.

1. Secure Your Initial Investment First

One of the best ways to take profits in crypto is to withdraw your initial investment early. This way, no matter what happens next, you won’t lose—because you’ve already recovered your original money.

Here’s how it works:

Let’s say you invest $1,000 in a cryptocurrency. A few months later, it doubled to $2,000. Instead of risking it all, you pull out your initial $1,000 and let the rest ride.

Why is this so effective?

- Zero risk to your original funds – Once you take out your capital, any gains or losses come from profit, not your money.

- Less stress – No more panic when the market swings. Your initial investment is already safe.

Now, think about two possible outcomes: If the price drops, you’ve already secured your money, so you don’t lose from your pocket. If the price climbs, you still have a stake in the market and can enjoy more gains without fear.

This simple strategy gives you confidence to invest—without the stress of losing everything. Every smart trader should use it.

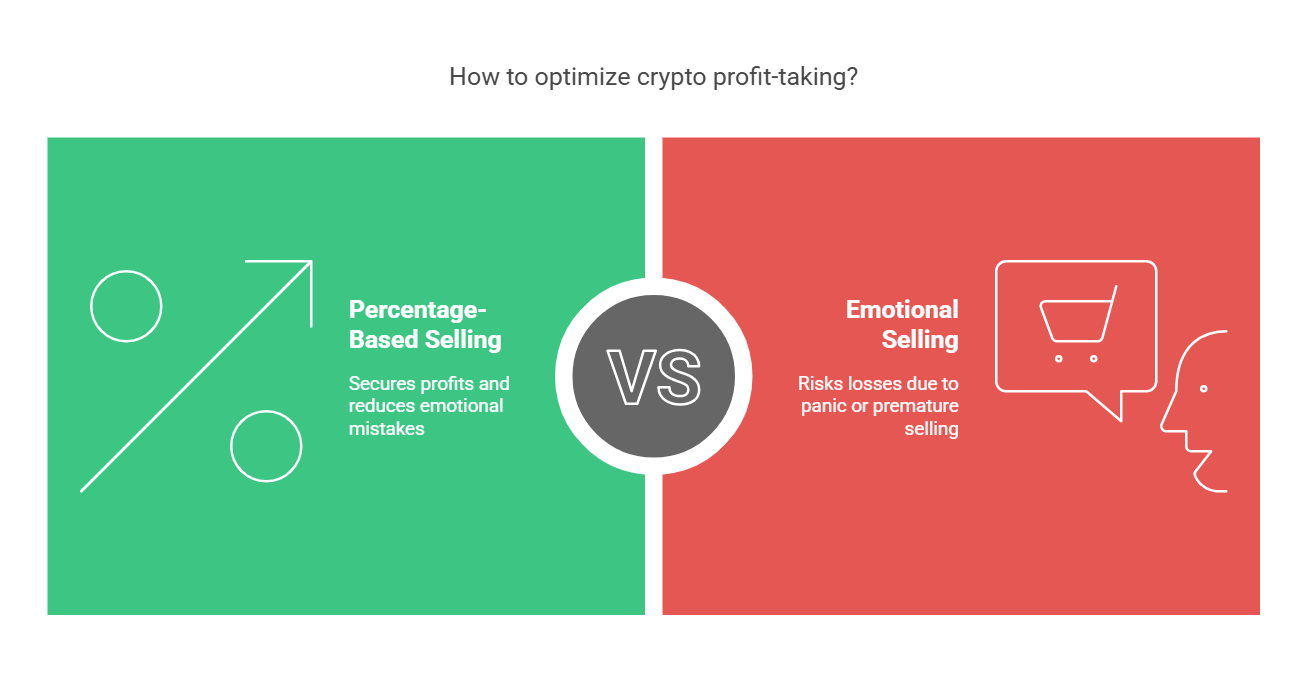

2. Lock in Profits at Pre-Set Percentage Gains

Another smart way to take profits in crypto is by setting pre-defined percentage gains. This method secures gains while keeping your investment growing.

Here’s how it works: Instead of guessing the perfect time to sell, set a structured plan based on percentage gains. For example:

- Sell 25% when the price rises 20%.

- Sell another 25% at 50% profit.

- Keep selling in stages as the price climbs.

This strategy removes stress. You take profits at different levels without worrying about timing the top. It also prevents emotional mistakes like panic selling or holding too long.

Why This Works

Many traders fall into two traps:

- Holding too long – Waiting for more gains, only to watch the market crash.

- Selling too early – Cashing out too soon and missing bigger profits.

A percentage-based selling plan avoids both. You secure profits while keeping some investment in case the price keeps rising.

For even better results, combine this method with the previous strategy. First, withdraw your initial investment to eliminate risk, then use percentage-based selling to secure steady profits over time.

For example, if you invest $1,000 and it doubles to $2,000. First, pull out your original $1,000—now, you’re risk-free. Then, instead of holding blindly, sell portions of your remaining crypto at pre-set targets to ensure steady profits.

Pro Tip: Use limit sell orders to automate your plan. No need to watch charts all day.

3. Sell at Strategic Price Targets

One of the highly effective ways to take profits in crypto is by setting price targets—and sticking to them. This removes emotions from your decisions, so you lock in real gains instead of watching numbers move on a screen.

Instead of selling randomly or on impulse, you set specific targets in advance. When the price hits your mark, you sell—no hesitation, second-guessing, or regret.

For example, if you buy Bitcoin at $80,000 and set a target of $100,000, you sell when it reaches that price. Even if it keeps rising, it doesn’t matter—you followed your plan, took profits, and made a smart move.

Many traders make the same mistake: holding too long, hoping for even bigger gains. They think, What if it goes higher? Then, the market crashes, and they regret not selling.

By sticking to price targets, you avoid greed, fear, and uncertainty. You take profits when planned, without emotional trading.

Once you sell at your target price, move on. If the price keeps rising, let it go. Your goal isn’t to sell at the very top—it’s to secure profits and protect them.

A winning trade is one where you walk away with gains. That’s what matters.

Recommended: How to Avoid Regret After Selling Crypto Too Early or Too Late

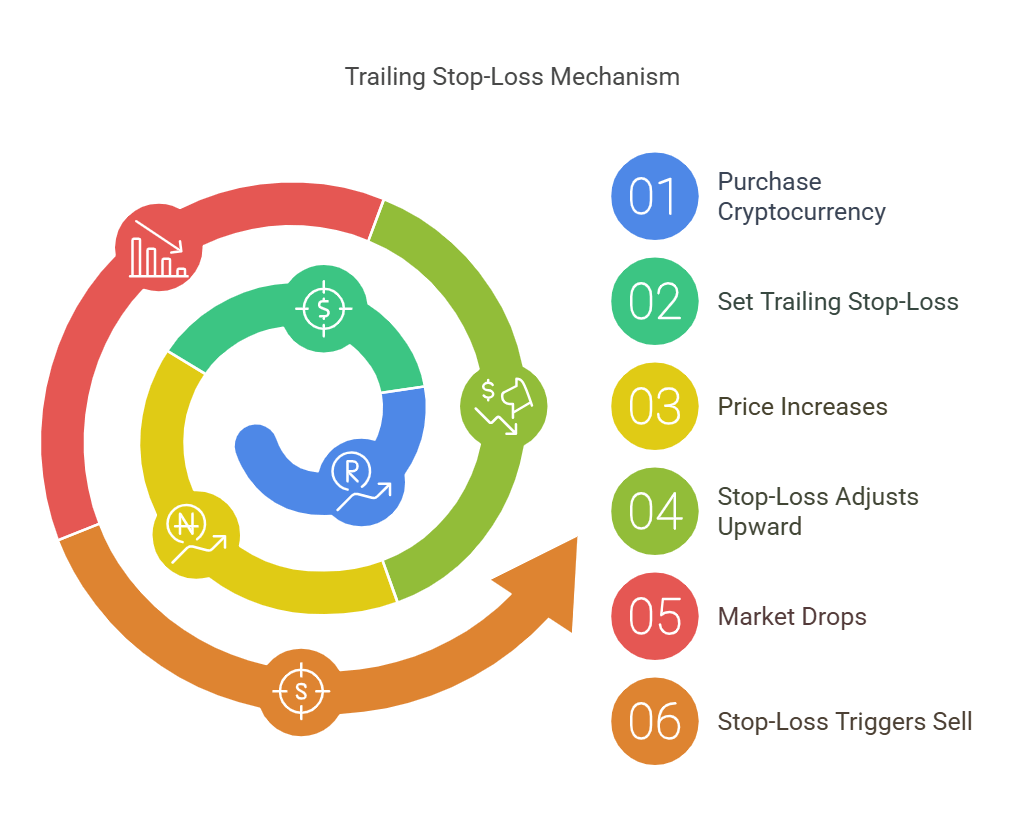

4. Use a Trailing Stop-Loss to Protect Profits

A trailing stop-loss is one of the most effective ways to secure profits while letting your investment grow. It removes the guesswork from selling and protects you from sudden drops—without constantly watching the market.

Here’s how it works: A trailing stop-loss moves up as the price rises, staying a set percentage below. If the price falls by that percentage, it triggers a sell, securing your profits before a bigger decline.

For example, say you buy a cryptocurrency at $50 and set a 10% trailing stop-loss. If the price climbs to $100, your stop-loss moves up to $90. If the price hits $200, the stop-loss follows at $180. But if the market suddenly drops to $180, it automatically sells, securing your gains.

This strategy is powerful because it allows your profits to grow while minimizing potential losses. It eliminates the need to track prices all day and helps prevent emotional decision-making.

For even better results, use this method after withdrawing your initial investment. That way, your remaining holdings grow while a trailing stop-loss protects them.

If you don’t want to stress about when to take profits in crypto, let a trailing stop-loss do the work. It’s an easy, automated way to take profits without second-guessing your decisions.

5. Exit the Market Strategically with DCA

Most traders know about Dollar-Cost Averaging (DCA) as a way to buy crypto, but it’s also a smart way to sell. Instead of cashing out all at once and hoping for the best, DCA lets you exit gradually, reducing risk while benefiting from potential price increases.

Here’s how it works: Rather than making one big sale, you break it into smaller, scheduled transactions. This approach helps you avoid selling too early and missing more gains or holding too long and watching profits disappear. Selling in portions secures profits while keeping you in the market.

For example, you might sell 10% of your holdings this week, another 10% next week, and continue as the price rises. If prices keep climbing, you still profit. If the market suddenly drops, you’ve already locked in gains along the way.

This strategy removes emotions from the process. Instead of panic-selling in a dip or hesitating at high prices, you follow a structured plan that reduces stress and regret. Many exchanges even offer recurring sell orders, making it easy to automate and stick to your strategy.

Additional Resources:

- The Costly Mistakes I Made During My First Crypto Bull Run

- 5 Best Exchanges for Selling Crypto with Low Fees

- How to Stay Sane During a Crypto Crash

- Best Security Practices for All Cryptocurrency Users

And guess what? We’re also on Instagram and Twitter(X). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is for informational purposes only. Do not rely solely on it for making investment decisions. It is not financial, tax, legal, or accounting advice. Always do your own research or consult a financial advisor before investing in cryptocurrency.