A crypto slang list for every new crypto investor and trader wishing to understand the industry like a pro.

Imagine you’re at a lively gathering of crypto enthusiasts, and suddenly, everyone’s tossing around terms like “HODL,” “FOMO,” and “DYOR” as if it’s a party game.

Feeling a bit lost? No need to fret – you’re not alone!

In this beginner-friendly guide, I’m here to unravel the mysterious language of crypto slang.

Think of it as your ultimate cheat sheet, your VIP ticket to the exclusive talk of crypto fans.

From ‘HODL’ to ‘FOMO,’ I’ve compiled the go-to crypto slang list that every new investor should have in their arsenal.

This journey promises to be enjoyable, so get ready to be entertained, educated, and, most importantly, armed with the crypto know-how you need to succeed.

Because, my friend, understanding these crypto slangs isn’t just about talking the talk – it’s about grabbing the opportunities that the crypto world brings to the table.

IMPORTANT: I've selected some really great blog posts that I think you'll absolutely love. They're waiting for you right at the bottom of this post. Don't forget to give them a read!Crypto Slang List for New Investors

These terms often sound like a secret language, but fear not – I’m here to explain them for you in plain and simple English.

1. DYOR

- Meaning:

- “DYOR” is an acronym for “Do Your Own Research.” It emphasizes the importance of individual investors conducting thorough research before making any investment decisions.

- Importance:

- DYOR encourages investors to take responsibility for their choices, reducing reliance on potentially biased information or recommendations.

- Proper research helps investors understand the risks, potential rewards, and fundamentals of a cryptocurrency project.

- Usage:

- “Before investing in any crypto, always remember to DYOR to make informed decisions.”

- “DYOR is a fundamental principle in the crypto space; relying on others without researching can lead to significant losses.”

- Tips:

- Explore Whitepapers: Read the project’s whitepaper to understand its goals, technology, and use cases.

- Check Team and Development: Investigate the project’s team, their experience, and the progress of the development.

- Community Feedback: Consider opinions from the crypto community, but balance them with your independent analysis.

2. FOMO

- Meaning:

- “FOMO” stands for Fear of Missing Out, and it’s a powerful psychological phenomenon where individuals feel anxiety or unease at the thought of missing out on potential opportunities or experiences, especially in the context of investments.

- Importance:

- In crypto, FOMO can drive investors to make impulsive decisions based on the fear that they might miss out on profits.

- It often leads to rushed investments without proper research or understanding of the market conditions.

- Usage:

- “I bought this altcoin because of FOMO, but now I regret not doing proper research.”

- “FOMO can be dangerous in investing; it’s essential to make decisions based on logic rather than emotions.”

- Tips:

- Research First: Always conduct thorough research before making investment decisions. Don’t let FOMO drive your choices.

- Set Clear Goals: Define your investment goals and stick to them. Avoid making decisions solely based on the fear of missing out.

- Stay Calm: Markets go through ups and downs. Avoid making impulsive decisions during times of heightened FOMO.

Read Also: The Psychology of Crypto Trading

3. ShitCoin

- Meaning:

- “Shitcoin” is a slang term used in the crypto community to refer to a cryptocurrency that is considered to be of low value, questionable quality, or lacking genuine substance. It is often used pejoratively to describe a coin with little to no utility, poor development, or associated with fraudulent activities.

- Importance:

- The term reflects a negative sentiment towards certain cryptocurrencies and is typically used to express skepticism or disdain for projects that are perceived as lacking legitimacy or credibility.

- Investors and community members may use the term to warn others about potential risks associated with investing in or supporting a particular crypto.

- Usage:

- “Be careful with that new token; many consider it a shitcoin due to its lack of a clear use case.”

- “The market is flooded with shitcoins; it’s crucial to do thorough research before investing.”

- Tips:

- Thorough Research: Before investing in any crypto, conduct thorough research on its technology, team, use case, and community support.

- Beware of Hype: Be cautious of projects that rely solely on hype or promises without clear evidence of progress.

4. FUD

- Meaning:

- “FUD” stands for Fear, Uncertainty, and Doubt. In the crypto space, it refers to the spread of negative or misleading information with the intention of creating fear and doubt among investors.

- Importance:

- FUD is often used as a tactic by individuals or groups to manipulate the market, induce panic selling, or damage the reputation of a particular cryptocurrency.

- Recognizing and understanding FUD is crucial for investors to make informed decisions and avoid being swayed by baseless claims.

- Usage:

- “Ignore the FUD; it’s an attempt to manipulate the market and create panic.”

- “The project faced FUD, but after a thorough investigation, it turned out to be unfounded.”

- Tips:

- Verify Information: Before reacting to information, especially negative news, verify its authenticity from reliable sources.

- Critical Thinking: Develop a critical mindset to distinguish between genuine concerns and intentional efforts to spread FUD.

- Long-Term Perspective: FUD often targets short-term reactions. Maintaining a long-term perspective can help withstand temporary market turbulence.

Read Also: 5 Most Popular Websites for Crypto News

5. AirDrop

- Meaning:

- An “Airdrop” in crypto refers to the distribution of free tokens or coins to a group of wallet addresses. This distribution is often used by blockchain projects as a marketing strategy, community engagement initiative, or a way to distribute a new cryptocurrency to a wider audience.

- Importance:

- Airdrops help projects build a community, increase awareness, and distribute tokens widely, fostering user adoption.

- Participants in airdrops usually receive free tokens without having to make a financial investment.

- Usage:

- “The project is planning an airdrop to reward early adopters and community members.”

- “To participate in the airdrop, users need to hold a certain amount of the project’s native tokens in their wallets.”

- Characteristics:

- Free Distribution: Airdrops involve giving away tokens for free to eligible participants.

- Community Building: Airdrops can attract and incentivize a community of users interested in the project.

- Marketing Tool: Projects use airdrops as a marketing strategy to increase visibility and attract attention.

Read Also: What Airdrop Means in Crypto and How it Works

6. HODL

- Meaning:

- “HODL” originated from a misspelled word “hold” in a Bitcoin forum post in 2013. It has since become a popular term in the crypto community. Essentially, “HODL” means holding onto your cryptocurrency assets instead of selling, no matter what the market is doing.

- Importance:

- HODLing is often associated with a long-term investment strategy.

- It reflects the belief that despite short-term market volatility, the value of your cryptocurrency will increase over time.

- HODLing helps you resist the urge to make quick decisions based on sudden market changes.

- Usage:

- “I’m not selling my Bitcoin, I’m going to HODL through market ups and downs.”

- “HODLing requires patience and a long-term perspective in the volatile crypto market.”

7. Shill

- Meaning:

- “Shill” is a term used in the crypto space to describe the act of promoting or endorsing a cryptocurrency for personal gain. Shilling often involves spreading positive information or hype about a project with the intention of encouraging others to invest.

- Importance:

- Identifying shilling is crucial for investors to distinguish genuine recommendations from potentially biased or manipulative promotions.

- Shilling can impact market sentiment and lead investors to make decisions based on misleading information.

- Usage:

- “Be wary of social media influencers shilling a particular cryptocurrency without providing comprehensive information.”

- “The project faced criticism for paying individuals to shill their token.”

- Tips:

- Verify Information: Cross-check information from multiple sources before making investment decisions.

- Question Overly Positive Claims: If the information seems overly positive and lacks critical details, it might be a shilling attempt.

- Focus on Fundamentals: Base investment decisions on the fundamental aspects of a project rather than promotional hype.

8. BagHolder

- Meaning:

- “Bagholder” is a term in the world of investing, particularly in cryptocurrencies, referring to an individual who is left holding a depreciating asset that has lost a significant portion of its value.

- Importance:

- Bagholders are often associated with investments that have performed poorly, and they may face challenges in recovering their losses.

- The term highlights the importance of risk management and avoiding holding onto losing positions for too long.

- Usage:

- “After the market crash, many investors became bagholders of overhyped altcoins.”

- “Selling at a loss is better than being a bagholder and hoping for a recovery that might not come.”

- Characteristics:

- Reluctance to Sell: Bagholders may be reluctant to sell at a loss, hoping for a future recovery.

- Lesson in Risk: The term serves as a reminder to investors about the risks of holding onto underperforming cryptocurrencies.

- Tips:

- Cut Losses: Consider selling cryptocurrencies that are consistently underperforming to prevent becoming a long-term bagholder.

- Learn from Experience: Use bagholding experiences as lessons in risk management and investment strategy.

Read Also: 7 Hard Lessons to Learn From a Crypto Crash

9. Whale

- Meaning:

- In crypto, a “whale” refers to an individual or entity that holds a substantial amount of a particular cryptocurrency. Whales are often characterized by their ability to influence the market due to the sheer size of their holdings.

- Importance:

- Whales have the power to impact the price of a cryptocurrency by making large trades, leading to significant market movements.

- Monitoring whale activities can provide insights into potential market trends and help investors make informed decisions.

- Usage:

- “Bitcoin’s recent price drop might be attributed to a whale selling off a large portion of their holdings.”

- “Whales are accumulating this altcoin, indicating potential positive sentiment in the market.”

- Tips:

- Whale Watching: Keep an eye on large transactions and movements in the wallets of major holders to gauge potential market shifts.

- Market Analysis: Consider whale activities as part of your overall market analysis but don’t solely rely on them for decision-making.

- Risk Management: Be aware that following whale actions blindly can be risky; always diversify and conduct your research.

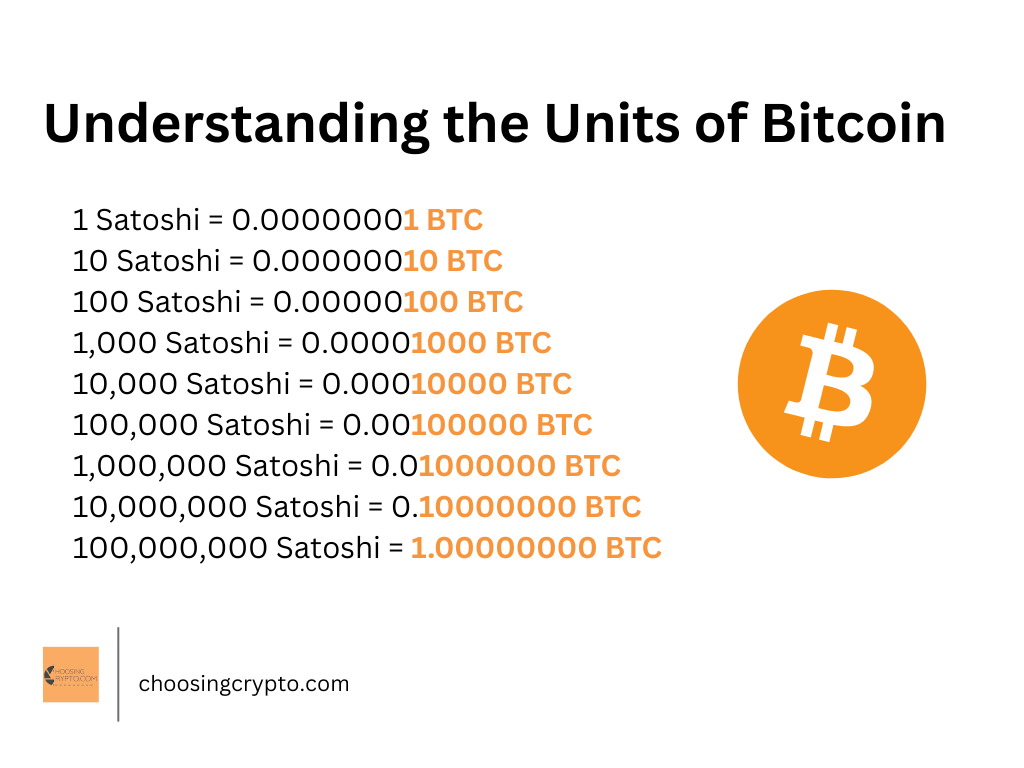

10. Satoshi

- Meaning:

- A “Satoshi” is the smallest unit of Bitcoin, named after its mysterious creator, Satoshi Nakamoto. One Bitcoin is divisible into 100,000,000 Satoshis.

- Importance:

- Satoshis allow for microtransactions within the Bitcoin network, providing divisibility that enhances the cryptocurrency’s practicality.

- Pricing assets in Satoshis is common in the crypto space, especially when dealing with fractions of a Bitcoin.

- Usage:

- “I bought a coffee for 10,000 Satoshis.”

- “Bitcoin’s price is often quoted in Satoshis, especially for altcoins.”

- Significance:

- Divisibility: Enables the use of Bitcoin for transactions of all sizes.

- Homage to Creator: The term pays homage to the pseudonymous creator of Bitcoin, Satoshi Nakamoto.

11. Pump and Dump

- Meaning:

- “Pump and Dump” is a manipulative trading strategy where the price of a cryptocurrency is artificially inflated (pumped) through misleading or false positive statements. Subsequently, the perpetrators sell off their cryptocurrencies at an inflated price, causing a significant price decline (dump) and leaving other investors with losses.

- Importance:

- Pump and dump schemes take advantage of unsuspecting investors who buy into the hype, hoping for quick profits.

- Recognizing the signs of a potential pump and dump is crucial for investors to avoid falling victim to such schemes.

- Usage:

- “Be cautious of sudden price surges; it might be a pump and dump scheme.”

- “The project faced criticism for being involved in a pump and dump operation.”

- Tips:

- Research and Due Diligence: Thoroughly research any investment opportunity, especially those promising quick and unrealistic returns.

- Beware of Hype: Be skeptical of overly positive information, especially if it seems exaggerated or lacks credible sources.

- Risk Management: Avoid getting swept up in the excitement and only invest what you can afford to lose.

Read Also: Most Common Crypto Scams and How to Avoid Them

12. ATH

- Meaning:

- “ATH” stands for All-Time High. In cryptocurrencies, it refers to the highest price point a particular crypto has ever reached since its inception.

- Importance:

- ATH is a significant metric for investors as it provides insight into the historical performance of a cryptocurrency.

- Investors often track ATH to gauge the potential for future price appreciation or to assess the overall health of a particular coin.

- Usage:

- “Bitcoin hit a new ATH today, reaching $60,000 per coin.”

- “Investors are optimistic about the project as it approaches its ATH.”

13. Bull Market

- Meaning:

- A “Bull Market” refers to a financial market condition characterized by rising asset prices, investor optimism, and positive sentiment. In a bull market, there is a general expectation that crypto prices will continue to increase over time.

- Importance:

- Bull markets are typically associated with growth, earnings, and favorable market conditions.

- Investors may adopt aggressive investment strategies, such as buying cryptocurrencies, increasing exposure to the market, or seeking investments that can potentially benefit from rising prices.

- Usage:

- “The crypto market is currently in a bull market, with prices reaching new all-time highs.”

- “During a bull market, investors often display confidence in the economy and are willing to take on more risk.”

- Characteristics:

- Rising Prices: Bull markets are characterized by a sustained increase in the prices of cryptocurrencies.

- Optimistic Sentiment: Investor sentiment is generally positive, with expectations of continued crypto growth and strong performance.

Read Also: A Beginner’s Guide to Bull Market in Crypto

14. Bear Market

- Meaning:

- A “Bear Market” refers to a financial market condition characterized by a prolonged period of declining prices for cryptocurrencies. In a bear market, investor sentiment is pessimistic, and there is a general expectation that crypto prices will continue to fall.

- Importance:

- Bear markets are typically associated with economic downturns, recessions, or unfavorable economic conditions.

- Investors may adopt defensive strategies, such as selling cryptocurrencies, reducing exposure to the market, or seeking investments that can potentially benefit from declining prices.

- Usage:

- “The crypto market is currently experiencing a bear market, with prices consistently trending downward.”

- “During a bear market, investors often seek stablecoins to preserve capital.”

- Tips:

- Diversification: Maintain a diversified portfolio to spread risk across different cryptocurrencies.

- Risk Management: During a bear market, consider reviewing and adjusting your investment strategy to manage risk effectively.

- Long-Term Perspective: Understand that bear markets are a natural part of market cycles, and maintaining a long-term perspective can help navigate through downturns.

15. Altcoin

- Meaning:

- “Altcoin” is a portmanteau of “alternative” and “coin.” It refers to any cryptocurrency other than Bitcoin. While Bitcoin was the first cryptocurrency, thousands of alternative coins (altcoins) have been created since then.

- Importance:

- Altcoins offer investors a variety of choices beyond Bitcoin, each with its unique features, use cases, and technologies.

- Diversifying a cryptocurrency portfolio with altcoins can provide exposure to different projects and potentially higher returns.

- Usage:

- “Ethereum, Ripple, and Litecoin are popular examples of altcoins.”

- “Investors often diversify their portfolios by holding a mix of Bitcoin and various altcoins.”

- Tips:

- Research Each Altcoin: Before investing, thoroughly research the altcoin’s purpose, technology, team, and community support.

- Risk Management: Understand that altcoins can be more volatile than Bitcoin. Only invest what you can afford to lose.

Read Also: 4 Top Websites to Find Live Prices of Every Crypto

16. Wallet

- Meaning:

- In crypto, a “wallet” is a digital tool that allows users to store, receive, and send cryptocurrencies. It doesn’t physically hold the coins; instead, it manages the public and private keys necessary for interacting with the blockchain.

- Importance:

- Wallets are essential for securely managing crypto holdings and conducting transactions.

- There are various types of wallets, each with its advantages and security features.

- Usage:

- “I use a hardware wallet to store my Bitcoin securely offline.”

- “Mobile wallets are convenient for daily transactions, while cold wallets offer enhanced security for long-term storage.”

- Tips:

- Security First: Prioritize security features when choosing a wallet, especially for long-term storage.

- Backup Your Keys: Always backup and securely store your wallet’s recovery phrase or private keys.

- Use Different Wallets: Consider using different wallets for different purposes, such as a hardware wallet for savings and a mobile wallet for everyday transactions.

Read Also: Everything You Should Know About Crypto Wallets

17. Rekt

- Meaning:

- “Rekt” is an internet slang term derived from the word “wrecked.” In crypto, it is used to describe a situation where an investor has experienced significant losses or is unsuccessful in their trades.

- Importance:

- “Rekt” is often used humorously or colloquially to express the severity of financial losses in the crypto market.

- It underscores the importance of risk management and the unpredictable nature of crypto investments.

- Usage:

- “I went all in on that altcoin, and now I’m totally rekt.”

- “Don’t invest more than you can afford to lose; you don’t want to end up rekt in a market downturn.”

- Tips:

- Risk Management: Only invest what you can afford to lose to reduce the impact of potential losses.

- Diversify: Avoid putting all your funds into a single crypto; diversification can help spread risk.

18. Stablecoin

- Meaning:

- A “Stablecoin” is a type of cryptocurrency designed to maintain a stable value by pegging it to a reserve of assets, typically a fiat currency like the US Dollar. The goal is to reduce the volatility often associated with other cryptocurrencies like Bitcoin.

- Importance:

- Stablecoins provide a more reliable medium of exchange and store of value, making them suitable for transactions and as a bridge between the traditional financial system and the crypto space.

- They offer a way for users to hold value in crypto without being exposed to the extreme price fluctuations seen in other digital assets.

- Usage:

- “I converted my Bitcoin to a stablecoin to avoid market volatility during a downturn.”

- “Merchants often prefer stablecoins for transactions as they offer a more predictable value compared to other cryptocurrencies.”

- Characteristics:

- Pegged Value: Stablecoins maintain a stable value by being pegged to a reserve asset, often a fiat currency.

- Low Volatility: Compared to many other cryptocurrencies, stablecoins experience lower price volatility.

- Widespread Use: Stablecoins are commonly used for trading, remittances, and as a stable unit of account in decentralized finance (DeFi) applications.

- Tips:

- Understand Peg Mechanism: Different stablecoins use various mechanisms to maintain their peg. Understand how each stablecoin achieves stability.

- Check Reserves: Some stablecoins are backed by reserves; it’s essential to verify the transparency and security of these reserves.

Read Also: Best Stablecoins to Use

19. Mining

- Meaning:

- “Mining” in cryptocurrencies refers to the process of validating transactions and adding them to the blockchain by solving complex mathematical problems. Miners use powerful computers to compete for the chance to add a new block to the blockchain and, in return, are rewarded with newly created cryptocurrency and transaction fees.

- Importance:

- Mining is vital for the security and decentralization of many blockchain networks.

- It is the mechanism by which new crypto coins or tokens are introduced into circulation, creating incentives for individuals to contribute computational power to the network.

- Usage:

- “Bitcoin miners play a crucial role in securing the network and validating transactions.”

- “The reward for mining a new block is halved approximately every four years in the Bitcoin network, known as the Bitcoin halving.”

- Characteristics:

- Proof-of-Work (PoW): The most common mining mechanism, where miners compete to solve cryptographic puzzles to add blocks to the blockchain.

- Mining Pools: Miners often join mining pools, combining their computational power to increase the chances of successfully mining a block and sharing the rewards.

- Energy Consumption: Mining, especially in proof-of-work systems like Bitcoin, can require significant computational power and energy consumption.

- Tips:

- Understand Mining Algorithm: Different cryptocurrencies use different mining algorithms. Understand the specific algorithm used by the crypto you are interested in.

- Consider Alternatives: Some cryptocurrencies use alternative consensus mechanisms like Proof-of-Stake (PoS) or Delegated Proof-of-Stake (DPoS), which do not involve traditional mining.

Read Also: Everything You Need to Know about Bitcoin Mining

20. ICO

- Meaning:

- An “Initial Coin Offering” (ICO) is a fundraising method commonly used by blockchain and crypto projects to raise capital. During an ICO, a new cryptocurrency or token is offered to the public in exchange for existing cryptocurrencies like Bitcoin or Ethereum.

- Importance:

- ICOs provide a means for blockchain projects to secure funding for development and operations.

- Investors participating in ICOs typically receive the newly created tokens, representing a stake in the project or access to its future services.

- Usage:

- “The project aims to raise funds through an ICO to develop its decentralized platform.”

- “Investors can participate in the ICO by sending Ethereum to the designated address in exchange for the project’s native tokens.”

- Characteristics:

- Crowdfunding: ICOs are a form of crowdfunding where a large number of participants contribute relatively small amounts of capital.

- Whitepaper: Projects typically release a whitepaper detailing their goals, technology, tokenomics, and use of funds to attract potential investors.

Read Also: What is an ICO in Crypto and How it Works

21. Mooning

- Meaning:

- “Mooning” in the crypto space refers to a significant and rapid increase in the price of a cryptocurrency, often resulting in reaching new all-time highs.

- Importance:

- Mooning signifies a period of substantial price growth and heightened market optimism.

- Investors often use the term to describe when a cryptocurrency’s value is soaring to the metaphorical “moon.”

- Usage:

- “Bitcoin is mooning after breaking through the resistance level.”

- “Altcoins have a tendency to moon during bull markets.”

- Characteristics:

- Rapid Growth: Mooning describes a quick and often dramatic increase in the value of a cryptocurrency.

- All-Time Highs: Mooning may result in the crypto reaching new record price levels.

22. DApp

- Meaning:

- “DApp” is an abbreviation for “Decentralized Application.” It refers to applications that operate on a decentralized network, typically a blockchain, rather than relying on a centralized server.

- Importance:

- DApps leverage blockchain technology to offer transparency, security, and immutability.

- They often run on smart contracts, self-executing contracts with the terms of the agreement directly written into code.

- Usage:

- “This blockchain game is a great example of a DApp, running on the Ethereum network.”

- “DApps aim to eliminate the need for intermediaries and provide users with more control over their data.”

23. Fiat

- Meaning:

- “Fiat” refers to a government-issued currency like the US dollar. It has value because a government maintains it and people have faith in its use for transactions.

- Importance:

- Fiat currencies are the traditional forms of money used in everyday transactions and are considered legal tender by the government that issues them.

- In crypto, buying and selling often involve converting between cryptocurrencies and fiat currencies.

- Usage:

- “Most daily transactions are conducted using fiat currency like dollars, euros, or yen.”

- “Investors often convert their crypto gains into fiat for practical use or to lock in profits.”

Additional Resources:

Excited to learn more about Bitcoin and cryptocurrencies? We’ve got some awesome resources below to help you out.

- 7 Best Ways to Secure Your Cryptocurrencies

- Top Ways to Make Money in the Crypto Market

- 20 Things You Should Never Do as a Crypto Investor/Trader

- How to Buy Crypto for The First Time

- 5 Best Crypto Exchanges For Beginners

- How to Become Successful in Crypto

- Crypto Trading Strategies for Different Market Conditions

And guess what? We’re also on Instagram and Twitter(X). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is intended for informational purposes only and should not be solely relied upon for making investment decisions. It does not constitute financial, tax, legal, or accounting advice. Additionally, I strongly recommend that you only invest in cryptocurrency an amount you are comfortable with potentially losing temporarily.

Read Also: 10 Reasons Why You Should Invest in Crypto