Ever heard about the “Bitcoin Halving” and thought, “What is the Halving of Bitcoin?” Well, you’re not alone on this crypto adventure!

Bitcoin, our trailblazing digital currency, is more than just a magical internet money. It plays by some fascinating rules and goes through events that keep it running smoothly.

One of these events, the Bitcoin Halving, is like the beating heart of the crypto world. It influences the supply, demand, and ultimately, the value of Bitcoin.

So, if you’ve ever wondered why Bitcoin fans get excited about the halving, almost like it’s the Super Bowl of crypto, get ready for some answers.

In this easy-to-follow guide, I’ll take you into the captivating world of Bitcoin Halving.

By the end, you won’t just know what the Halving of Bitcoin is; you’ll also understand why it’s a big deal in the crypto world.

IMPORTANT: I've selected some really great blog posts that I think you'll absolutely love. They're waiting for you right at the bottom of this post. Don't forget to give them a read!What is the Halving of Bitcoin?

Bitcoin Halving is a process that reduces the rate at which new Bitcoins are created and introduced into circulation.

Here’s how it works: In the Bitcoin protocol, there’s a pre-defined schedule for how new Bitcoins are issued to miners as rewards for validating transactions and securing the network.

This reward is known as the “block reward.”

Initially, when Bitcoin was created, the block reward was set at 50 Bitcoins per block.

However, approximately every four years or after every 210,000 blocks mined, the block reward is cut in half. Hence the term “halving.”

This reduction means that miners receive only half of the previous reward for each block they mine.

The purpose of Bitcoin Halving is twofold:

- Scarcity: By reducing the rate of new Bitcoin creation, Bitcoin Halving helps maintain the scarcity of Bitcoin. With a fixed supply cap of 21 million Bitcoins, halving events slows down the rate at which new Bitcoins enter circulation, making them increasingly scarce over time.

- Incentive Alignment: Bitcoin Halving also serves to align incentives within the Bitcoin network. As the block reward decreases, miners must rely more on transaction fees to sustain their operations.

Bitcoin halvings will continue until we hit the magic number of 21 million Bitcoins in circulation, which is expected around the year 2140.

Once we’ve got all 21 million Bitcoins in circulation, miners won’t be getting new coins as a reward anymore.

Nope, instead, they’ll be relying on fees that users pay for processing transactions.

Read Also: Everything You Need to Know about Bitcoin Mining

Mechanism Behind The Halving of Bitcoin

Now that we’ve got a grip on what the Halving of Bitcoin is all about, let’s go deeper into how this intriguing event works and what it means for the overall supply of Bitcoin.

Fixed Supply and Controlled Issuance:

Basically, Bitcoin runs on a clever idea of limited supply. There will only ever be 21 million Bitcoins, a deliberate choice made by Satoshi Nakamoto, the mysterious creator of Bitcoin.

This fixed supply is intended to mirror the scarcity of precious metals like gold.

Nakamoto implemented a schedule within the Bitcoin protocol to ensure there’s controlled issuance.

For every 210,000 blocks mined, the reward that miners receive for validating transactions is halved.

This is where the term “halving” comes from.

Scheduled Reductions:

Bitcoin Halving happens roughly every four years. It’s based on how long it takes for the network to mine 210,000 blocks.

The first Halving of Bitcoin was in 2012, and the most recent one was in 2020.

Mining and Proof-of-Work:

To understand why Bitcoin Halving matters, we need to talk about the mining process.

Miners use super powerful computers to solve tricky maths puzzles, called Proof-of-Work, to validate transactions and add them to the blockchain.

In return for their efforts, they receive the block reward.

As the reward gets smaller with each halving, miners earn fewer new Bitcoins for each block they mine.

This has two big effects: it slows down the rate at which new Bitcoins enter circulation and it means miners rely more on transaction fees to keep their operations going.

Read Also: How a New Bitcoin is Created

When Was the First Bitcoin Halving Date?

The very first Halving of Bitcoin happened on November 28, 2012, right after miners had mined 210,000 blocks.

So, before this big event, when miners managed to mine a block, they would get a whopping 50 Bitcoins as a reward.

But, after the halving in 2012, the reward for mining a block dropped by half, down to 25 Bitcoins. Yep, you read that right – half the loot for the same amount of work!

And guess what? This halving caused a real stir in the price of Bitcoin. It shot up in a big way!

Less new Bitcoin, but more value. Who wouldn’t want that?

When Was the Last Halving of Bitcoin?

The last Halving of Bitcoin occurred on May 11, 2020. It was the third time this event took place.

Before the halving, miners used to get 12.5 Bitcoins, but after the halving, the reward went down to 6.25 Bitcoins.

And guess what? Just like the previous times this happened, the price of Bitcoin went up.

It’s like when your favorite toy becomes rare, everyone wants it more, so the price goes higher.

Next Halving of Bitcoin

No one really knows the exact date or month when the next Halving of Bitcoin will happen.

That’s because it’s not set on a calendar but is controlled by a computer program.

Instead, it’s scheduled based on the number of blocks added to the Bitcoin blockchain.

This makes it a bit unpredictable.

However, since a halving occurs roughly every 210,000 blocks, we’re anticipating the next one to take place sometime between March and May 2024.

What’s interesting is that after the 2024 Bitcoin Halving, the reward for adding a new block to the blockchain will go down from 6.25 Bitcoins to 3.125 Bitcoins.

Just like in the past when this has happened, we’re hopeful that this halving will bring about a positive impact for Bitcoin.

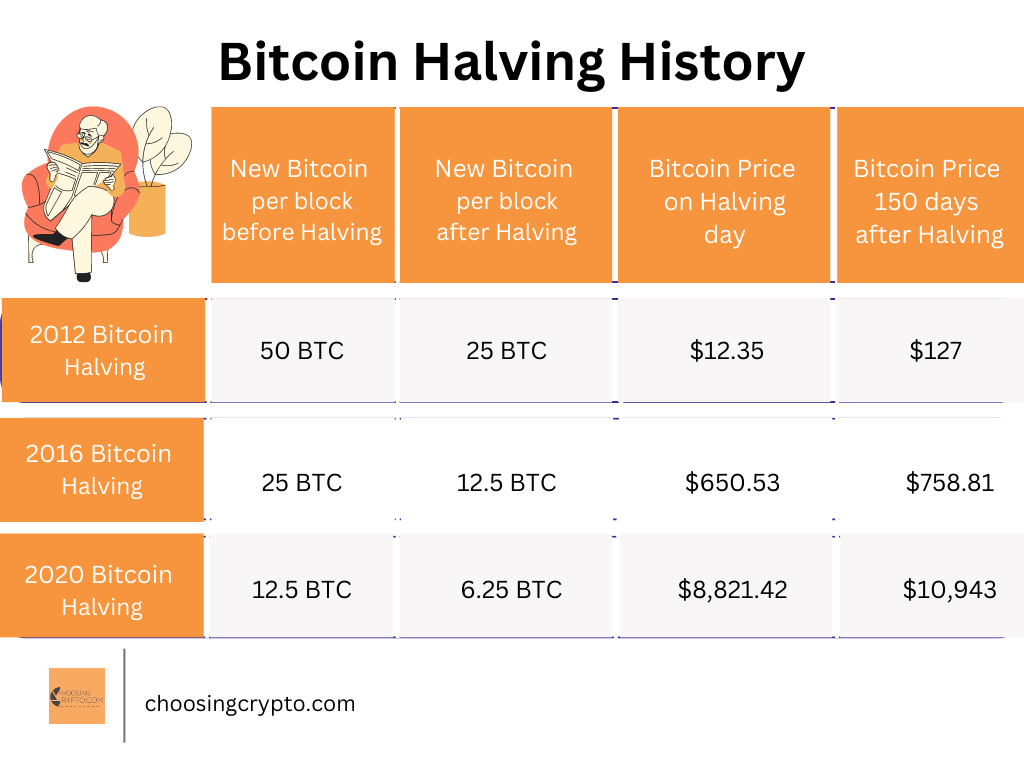

Bitcoin Halving Dates History

Below you will see the date history for past Bitcoin halvings.

2012 Bitcoin Halving

This first-ever Halving of Bitcoin occurred on November 28th, 2012.

Before the halving, miners were getting 50 Bitcoins for every block they mined.

After the halving, this reward was halved to 25 Bitcoins per block mined.

On the day of this halving, the price of Bitcoin was $12.35. After 150 days, the price had increased to $127.

2016 Bitcoin Halving

The second Bitcoin Halving occurred on July 9th, 2016.

Before the halving, miners were getting 25 Bitcoins for every block they mined.

After the halving, this reward was halved to 12.5 Bitcoins per block.

On the day of this halving, the price of Bitcoin was $650.63. After 150 days, the price had increased to $758.81.

2020 Bitcoin Halving

Moving on to the third Halving of Bitcoin, which happened on May 11, 2020.

Before this event, miners were receiving 12.5 Bitcoins for each block they mined.

However, after the halving, this reward was further reduced to 6.25 Bitcoins per block.

On the day of the halving, the price of Bitcoin was $8821.42.

And, you guessed it, 150 days later, the Bitcoin price had risen to $10,943.

Bitcoin Halving Frequently Asked Questions

1. What is Bitcoin Halving?

Bitcoin Halving is a pre-programmed event in the Bitcoin protocol where the reward for mining new blocks is reduced by half approximately every four years. It’s a mechanism designed to control the issuance of new Bitcoins and maintain scarcity in the cryptocurrency.

2. When does Bitcoin Halving occur?

Bitcoin Halving events occur approximately every four years or after every 210,000 blocks mined on the Bitcoin network. The exact timing is determined by the protocol and is not subject to human intervention.

3. Why does Bitcoin Halve?

Bitcoin Halving is part of the core design of Bitcoin and serves to limit the supply of new Bitcoins entering circulation over time. By reducing the rate of new coin issuance, Bitcoin becomes increasingly scarce, which may contribute to its value proposition as a store of value and digital asset.

4. How does Bitcoin Halving affect miners?

Bitcoin Halving reduces the block reward that miners receive for validating transactions and securing the network. This reduction in rewards can impact miners’ profitability and may require them to adjust their operations or rely more on transaction fees to sustain their activities.

5. What happens after all 21 million Bitcoins are mined?

Once all 21 million Bitcoins are mined, no new coins will be created, and miners will rely solely on transaction fees for revenue. This scenario is expected to occur gradually over several decades, with the final Bitcoin mined sometime in 2140.

6. Does Bitcoin Halving affect transaction fees?

Yes, Bitcoin Halving can influence transaction fees. As the block reward decreases, miners become more dependent on transaction fees for revenue. This can result in a more competitive fee market, potentially affecting transaction processing times.

Additional Resources:

Excited to learn more about Bitcoin and cryptocurrencies? We’ve got some awesome resources below to help you out.

- 10 Less-Known Facts about Bitcoin

- What Exactly is Bitcoin? A Complete Guide

- 20 Things You Should Never Do as a Crypto Investor/Trader

- How to Start Trading Crypto as a Beginner

- 7 Misconceptions about Bitcoin to Stop Believing

- What is an ICO in Crypto and How it Works

- 5 Best Crypto Exchanges to Use

- What Airdrop Means in Crypto

And guess what? We’re also on Instagram and Twitter(X). Join us there for even more fun and useful content!

The information provided here is intended for informational purposes only and should not be solely relied upon for making investment decisions. It does not constitute financial, tax, legal, or accounting advice. Additionally, I strongly recommend that you only invest in cryptocurrency an amount you are comfortable with potentially losing temporarily.

Read Also: Best Crypto Hardware Wallet for Storing Crypto Offline