In crypto trading, you might hear the term “slippage” tossed around quite a bit. But what is Slippage in crypto trading?

Picture yourself in a bustling market, aiming to buy some delicious apples at a certain price. But just as you get to the vendor, the price has unexpectedly gone up, leaving you with fewer apples than you expected for the same cash. That, my friend, is slippage in a nutshell!

So, in this beginner’s guide, we’re going to delve into what slippage in crypto trading is all about.

I’ll uncover why it happens, and, most importantly, how you can minimize its impact on your crypto trading.

Ready? Let’s go into this enlightening journey to unravel the mysteries of slippage in crypto trading!

IMPORTANT: I've selected some really great blog posts that I think you'll absolutely love. They're waiting for you right at the bottom of this post. Don't forget to give them a read!What is Slippage in Crypto Trading?

Slippage in crypto refers to the difference between the expected price of a trade and the actual price at which the trade is executed.

Imagine you want to buy some Bitcoin at a certain price, say £50,000 per coin. But by the time your order is processed by the exchange, the price has changed. Maybe lots of people suddenly want to buy Bitcoin, so its price jumps to £51,000.

That difference between what you expected to pay and what you actually paid is called slippage.

So, instead of getting your Bitcoin for £50,000 as you hoped, you end up paying £51,000 because of this slippage.

Understanding slippage is super important, especially if you’re just starting out in crypto.

If there’s a high slippage, you might end up paying more for a cryptocurrency than you intended when buying. Or, if you’re selling, you could receive less money than you thought, leading to losses.

Read Also: What Are Maker and Taker Fees in Crypto?

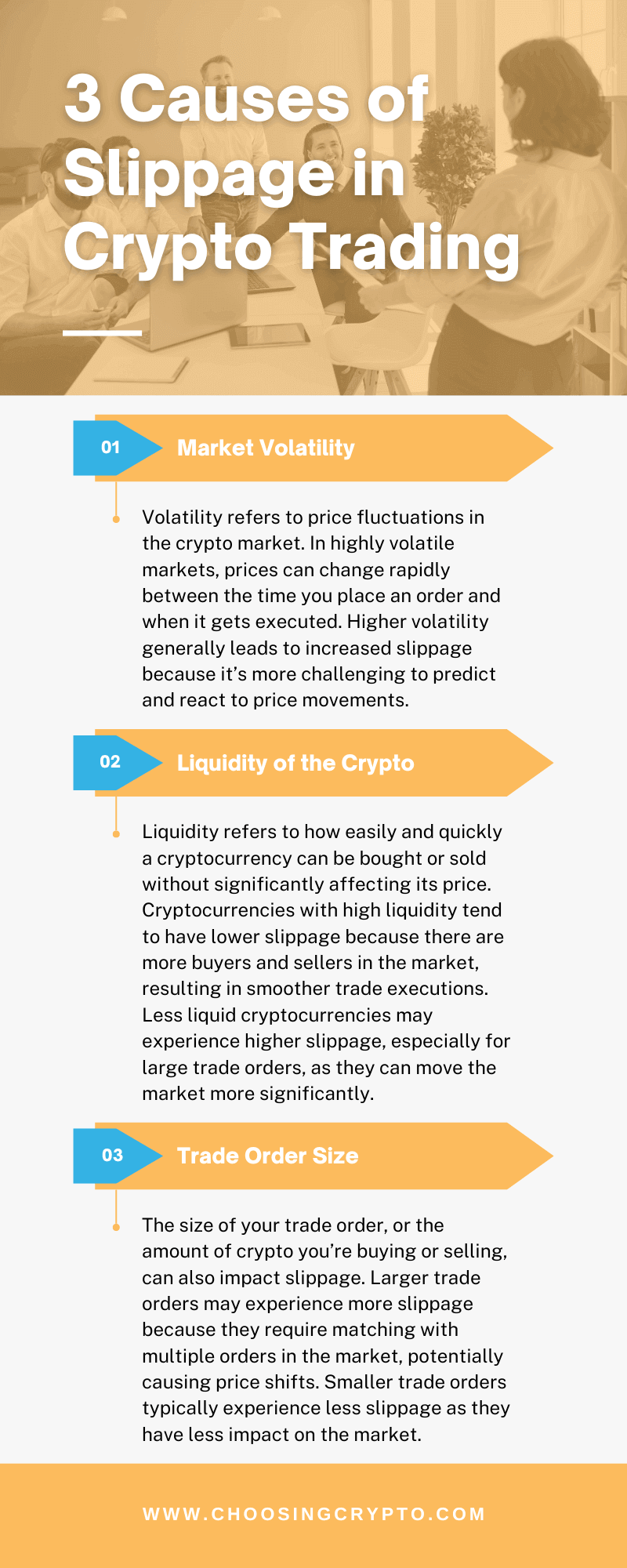

Causes of Slippage in Crypto Trading

Now that we have a basic understanding of what slippage is, let’s take a closer look at the causes of slippage in your crypto trades.

- Market Volatility: Volatility refers to price fluctuations in the crypto market. In highly volatile markets, prices can change rapidly between the time you place an order and when it gets executed. Higher volatility generally leads to increased slippage because it’s more challenging to predict and react to price movements.

- Liquidity of the Crypto: Liquidity refers to how easily and quickly a cryptocurrency can be bought or sold without significantly affecting its price. Cryptocurrencies with high liquidity tend to have lower slippage because there are more buyers and sellers in the market, resulting in smoother trade executions. Less liquid cryptocurrencies may experience higher slippage, especially for large trade orders, as they can move the market more significantly.

- Trade Order Size: The size of your trade order, or the amount of crypto you’re buying or selling, can also impact slippage. Larger trade orders may experience more slippage because they require matching with multiple orders in the market, potentially causing price shifts. Smaller trade orders typically experience less slippage as they have less impact on the market.

How to Minimize Slippage in Crypto Trading

Now let’s explore some practical strategies that beginners can implement to minimize slippage when trading cryptocurrencies:

- Use Limit Orders Instead of Market Orders: Instead of executing trades at the current market price with market orders, consider using limit orders to specify the price at which you’re willing to buy or sell. With limit orders, you have more control over the execution price of your trades, which can help minimize slippage. By setting a target price and waiting for the market to reach that level, you reduce the risk of being affected by sudden price fluctuations.

- Choose Cryptocurrencies with High Liquidity: Liquidity plays a crucial role in determining the level of slippage in trading. Opt for cryptocurrencies with high trading volume and liquidity, as they tend to have tighter bid-ask spreads and smoother trade executions. Popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) typically have higher liquidity compared to less well-known altcoins.

- Adjust Trade Order Sizes: Be mindful of the size of your trade orders, as larger orders can increase the likelihood of slippage. Consider breaking down large orders into smaller increments to reduce their impact on the market and minimize slippage.

Additional Resources:

Excited to learn more about Bitcoin and cryptocurrencies? We’ve got some awesome resources below to help you out.

- The Importance of Liquidity in Crypto Trading

- 5 Top Crypto Risk Management Practices for Traders and Investors

- Best Tools to Use for Crypto Trading

- Top 5 Indicators for Trading Crypto

- 5 Best Crypto Exchanges for Every Trader

- What are Trading Pairs in Crypto?

And guess what? We’re also on Instagram and Twitter(X). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is intended for informational purposes only and should not be solely relied upon for making investment decisions. It does not constitute financial, tax, legal, or accounting advice. Additionally, I strongly recommend that you only invest in cryptocurrency an amount you are comfortable with potentially losing temporarily.

Read Also: Crypto Trading Strategies for Different Market Conditions