In 2009, Bitcoin was worth almost nothing. Today, it’s everywhere. But what exactly is cryptocurrency, and why does it matter now more than ever?

Maybe you’ve seen Bitcoin’s price on the news. Maybe a friend said they made money from crypto, or lost it all. Either way, it’s clear: something big is happening.

Money is going digital. Trust in old systems is breaking down. Understanding cryptocurrency isn’t just interesting—it’s becoming necessary.

Whether you’re curious, skeptical, or secretly hoping to be early to the next big thing, this guide is for you.

By the end, you’ll know enough to talk about cryptocurrency without feeling lost. You’ll also have the basics to take your first steps into the digital money revolution with confidence.

Cryptocurrency Uncovered: What Is It Really?

Cryptocurrency is a type of digital money that exists only online. Unlike the cash in your wallet or the funds in your bank account, it has no physical form—no coins, no paper. It’s entirely virtual.

The term “crypto” comes from cryptography, a method of securing communication. Cryptocurrencies use cryptography to protect transactions, making them safe and trustworthy. The “currency” part refers to its role as money—you can send it, receive it, and even use it to make purchases.

A standout feature of cryptocurrency is its independence. Unlike traditional money, it’s not controlled by banks or governments. Instead, it operates through a revolutionary technology called blockchain. A blockchain is a public ledger that records all transactions. This system is powered by a global network of computers, so no single entity has control.

Bitcoin, the first and most popular cryptocurrency, led the way for others like Ethereum, Litecoin, and Solana. Each has unique features and uses.

At its core, cryptocurrency empowers you. It puts you in charge of your money, offering freedom from traditional financial systems.

How Is Cryptocurrency Created?

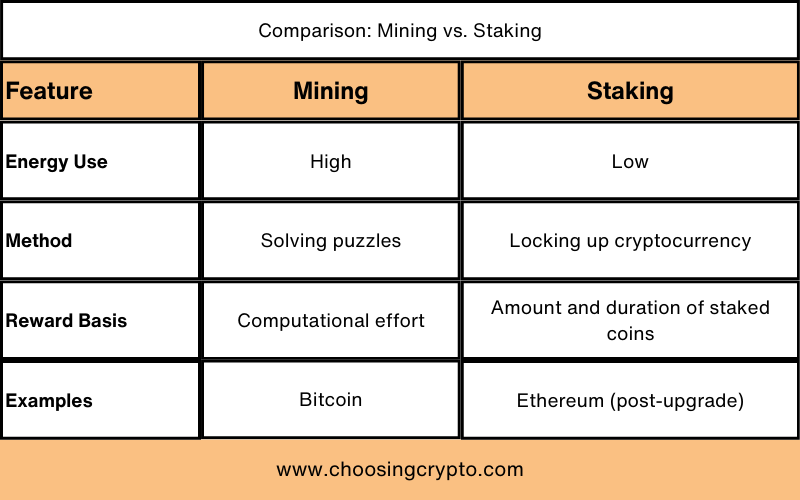

Cryptocurrencies are mainly created using two main methods: mining and staking.

1. Mining

Mining involves creating new coins and verifying transactions by solving complex mathematical puzzles. This process, called Proof of Work (PoW), ensures the blockchain’s security and integrity. Miners compete to solve these puzzles, and the first to succeed earns the right to add a block of transactions to the blockchain. As a reward, they receive newly created cryptocurrency. Bitcoin is a well-known example of a cryptocurrency that uses mining.

2. Staking

Staking is an energy-efficient alternative to mining. It’s used in networks with Proof of Stake (PoS) or similar systems. Participants lock up a portion of their cryptocurrency as a “stake.” The network randomly selects one to validate transactions and add a block to the blockchain. In return, they earn rewards like new coins or transaction fees. Ethereum, after transitioning to Ethereum 2.0, is a popular cryptocurrency that now relies on staking.

How Does Cryptocurrency Work?

Cryptocurrencies operate on a revolutionary technology called blockchain. Simply put, a blockchain is a digital ledger that securely records transactions. It’s transparent and accessible to anyone.

Think of it as a series of interconnected blocks, each containing transaction records. When one block is full, it links to the previous one, forming a continuous chain. This design decentralizes control, ensuring no single authority manages the data. The result? Greater security and fairness.

Key Features of Blockchain

- Transparency: Anyone can view the full transaction history.

- Immutability: Recorded transactions cannot be changed or deleted.

- Security: Cryptographic techniques protect the data from tampering.

When you send cryptocurrency, your transaction is broadcast across the network for validation. Miners or validators check its authenticity before adding it to the blockchain. Once approved, the funds appear in the recipient’s wallet.

This process is fast—usually completed within minutes, no matter where the recipient is. Plus, transaction fees are much lower than traditional banking methods.

Types of Cryptocurrencies

Cryptocurrencies come in many forms, each serving a unique purpose or solving a specific problem. Here are the main categories you should know:

1. Bitcoin

Launched in 2009, Bitcoin is the first and most well-known cryptocurrency. Created by an anonymous individual or group known as Satoshi Nakamoto, it operates as a decentralized digital currency. With a fixed supply of 21 million coins, Bitcoin is often seen as “digital gold,” valued for its scarcity and use as a store of value.

2. Altcoins

Altcoins include all cryptocurrencies other than Bitcoin. Some aim to improve Bitcoin’s limitations, while others introduce new features. For example:

- Ethereum revolutionized blockchain with smart contracts, enabling decentralized apps (dApps).

- Litecoin focuses on faster transactions and lower fees.

Altcoins expand the possibilities of blockchain beyond digital currency.

3. Stablecoins

Stablecoins are designed to maintain a stable value by being pegged to assets like the US dollar or gold. They reduce the volatility of cryptocurrencies, making them more predictable. Popular examples include Tether (USDT) and USD Coin (USDC), often used as bridges between crypto and traditional finance.

4. Privacy Coins

Privacy coins prioritize user anonymity by hiding transaction details, including amounts and participants. These coins appeal to users seeking confidential transactions. Notable examples are Monero (XMR) and Zcash (ZEC).

5. Other Categories

Beyond the main types, there are niche cryptocurrencies that serve specific purposes, such as:

- Memecoins (e.g., Dogecoin) for fun and community-driven value.

- Utility tokens for accessing services or products within a platform.

- Governance tokens for voting in decentralized organizations.

- DeFi tokens, NFT tokens, AI tokens, and gaming tokens for more specialized use cases.

What Makes Cryptocurrency Revolutionary?

Cryptocurrency isn’t just another form of money. It’s a revolutionary technology reshaping finance and tech. By challenging traditional systems, it creates new ways to manage and interact with money. Here’s how cryptocurrency is changing the game:

1. Decentralization

Cryptocurrencies run on decentralized networks, unlike traditional financial systems controlled by banks or governments. This setup ensures no single authority has full control, reducing risks like manipulation or censorship. Decentralization gives you greater financial freedom and independence.

2. Transparency and Immutability

Every cryptocurrency transaction is recorded on a blockchain—a public, tamper-proof ledger. This ensures clear visibility and high security, protecting against fraud and data alteration. With blockchain, trust isn’t optional—it’s built-in.

3. Borderless Transactions

Sending money worldwide is seamless with cryptocurrency. No middlemen. No high fees. Transactions are fast, no matter the distance, making crypto ideal for international payments, remittances, and global trade.

4. Limited Supply

Many cryptocurrencies, like Bitcoin, have a capped supply. For instance, only 21 million Bitcoins will ever exist. This scarcity prevents inflation and helps maintain value over time—unlike fiat currencies, which can lose value with overprinting.

5. Promoting Financial Inclusion

Cryptocurrency unlocks financial services for millions without bank accounts. With just a smartphone and internet access, anyone can store money, make payments, and participate in the global economy.

How to Buy Cryptocurrency

Here are four simple and reliable ways to make your first purchase:

1. Crypto Exchanges

Crypto exchanges are the most popular platforms for buying cryptocurrencies. Sites like Binance, Bybit, and Gate.io let you create an account, verify your identity, and purchase crypto with local currencies like USD or EUR. Many exchanges also offer mobile apps, so you can trade anytime, anywhere.

2. Bitcoin ATMs

Bitcoin ATMs make buying crypto fast and convenient. Visit a nearby machine, insert cash, and enter your crypto wallet address to receive your funds. These ATMs are perfect for quick, in-person transactions.

3. Peer-to-Peer (P2P) Platforms

P2P platforms connect buyers and sellers directly. You can pay with methods like bank transfers, PayPal, or gift cards. Agree on a price and payment method with the seller, but always check reviews and ratings for safety.

4. Friends or Family

If you’re lucky enough to know someone who already owns cryptocurrency, they can help you get started. They can transfer some crypto to your wallet in exchange for cash or another agreed payment method. Important: Always deal with people you know personally and trust. Never send money to someone claiming to sell crypto on the internet whom you’ve never met—they could be scammers.

Need help getting started? (Read my step-by-step guide on how to buy your first cryptocurrency here.)

What Can You Do With Cryptocurrency?

Curious about what cryptocurrency can do for you? Let’s dive into some surprising ways to use crypto!

1. Make Purchases

Did you know you can use cryptocurrency to pay for everyday purchases? Millions of businesses now accept Bitcoin, Ethereum, and other digital currencies. From buying electronics, cars, subscribing to digital services to booking vacations, crypto makes payments quick and seamless. Major companies like Microsoft, Shopify, and Overstock are leading the charge, making it easier than ever to spend your crypto.

2. Invest for Long-Term Growth

Crypto is often called “digital gold” for a reason. Many investors hold coins like Bitcoin in hopes of long-term growth. For example, a $100 Bitcoin investment in 2010 would be worth over $128 million today. While past performance doesn’t guarantee future success, crypto offers exciting possibilities for those looking to grow their wealth.

3. Trade and Profit from Price Swings

By buying low and selling high, you can capitalize on price fluctuations. Platforms like Binance and Bybit make trading accessible, but remember—successful trading requires a good strategy and a thorough understanding of the market.

4. Earn Passive Income with Staking

Want your crypto to work for you? Try staking. Certain cryptocurrencies let you earn rewards by committing your coins to support the blockchain. It’s an easy way to generate passive income while contributing to the network’s security.

… plus more

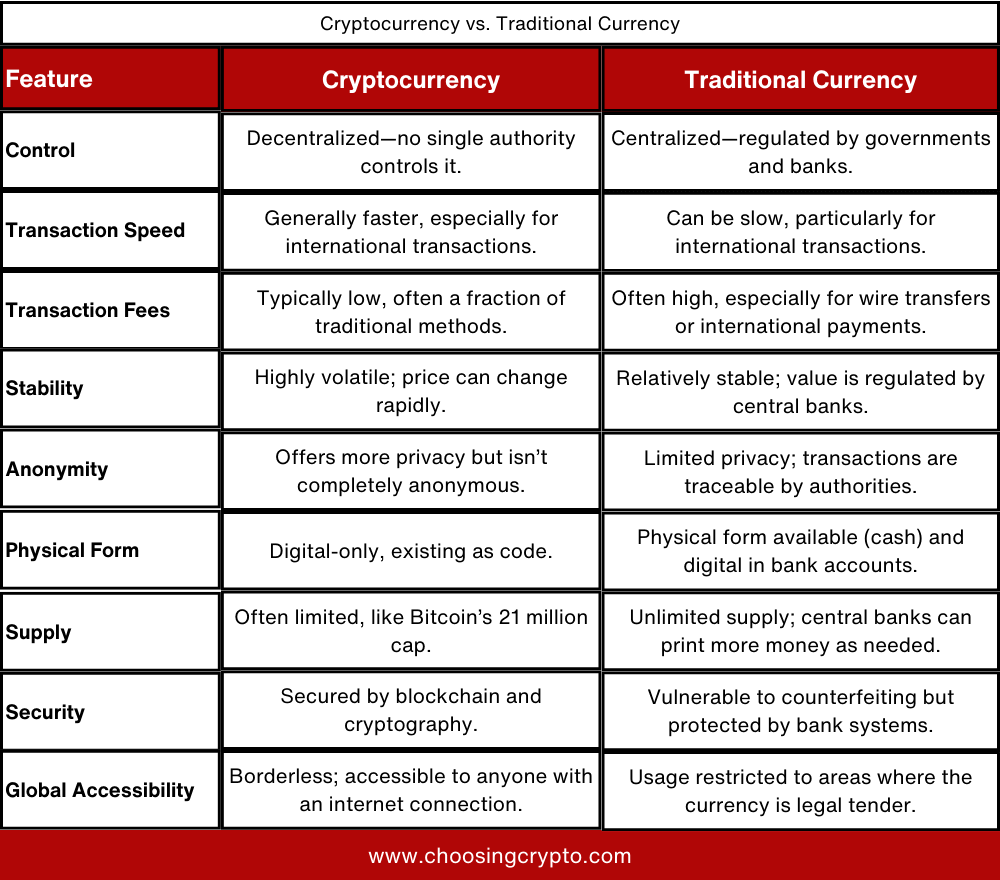

Cryptocurrency vs. Traditional Currency

Cryptocurrency and traditional currency both serve the same purpose: enabling transactions and storing value. However, they operate in very different ways. Let’s take a closer look at what sets them apart.

Risks and Challenges Associated with Cryptocurrencies

Cryptocurrencies offer exciting opportunities but come with risks you can’t ignore. To navigate the crypto space wisely, here’s what you should know:

1. Volatile Prices

Crypto prices can change dramatically in hours. Bitcoin, for instance, has seen huge spikes and sharp drops over the years. If you’re not ready for this kind of volatility, it can feel overwhelming.

2. Security Risks

While blockchain technology is secure, crypto wallets and exchanges can be vulnerable to hacks. Choosing reputable platforms and following strong security practices are essential to protect your funds.

3. Scams Are Common

Fraudsters target beginners with fake websites, phishing emails, and deceptive investment offers. Always double-check sources and research thoroughly before investing.

4. Environmental Concerns

Some cryptocurrencies, especially those using proof-of-work (PoW) mining, consume significant energy. This raises environmental concerns and drives interest in greener alternatives like proof-of-stake (PoS).

Common Misconceptions About Cryptocurrency

Cryptocurrency is often surrounded by myths due to its complexity and rapid rise in popularity. Let’s break down some common misconceptions and reveal the truth.

1. Cryptocurrencies Are Only for Illegal Activities

Yes, some illegal activities have involved cryptocurrencies, but the same is true for cash. Most crypto transactions are legitimate, used for shopping, investing, or transferring money. Thanks to blockchain technology, crypto transactions are often more transparent and traceable than cash.

2. Cryptocurrencies Are Completely Anonymous

Cryptos offer privacy, but they’re not fully anonymous. Transactions on public blockchains like Bitcoin are recorded and can often be traced with the right tools. The better term is “pseudonymous” rather than “anonymous.”

3. Cryptocurrencies Are Just a Scam

While scams exist in the crypto world, cryptocurrencies themselves aren’t scams. Established ones like Bitcoin and Ethereum have proven their reliability over time. Their underlying blockchain technology also powers real-world applications.

4. You Need a Lot of Money to Invest

This is a myth! Cryptocurrencies are highly divisible. You can start with as little as $25 or less, making it accessible to anyone.

5. Governments Will Ban Cryptocurrencies

Some governments regulate or ban cryptocurrencies, but others embrace them. For instance, El Salvador and the Central African Republic have adopted Bitcoin as legal tender, reflecting growing global acceptance.

Additional Resources:

- How to Store Your Crypto Sacurely: Best Ways

- Top 5 Crypto Exchanges for Beginners to Buy & Store Cryptocurrencies

- 7 Best Ways to Secure Your Crypto From Being Stolen

And guess what? We’re also on Instagram and Twitter(X). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is for informational purposes only. Do not rely solely on it for making investment decisions. It is not financial, tax, legal, or accounting advice. Always do your own research or consult a financial advisor before investing in cryptocurrency.