So, you’ve heard all the buzz about making big money in the crypto world, right? But what you might not have been told yet is how to research a crypto project properly before you decide to invest your hard-earned cash.

You see, making it big in the crypto scene isn’t just about being lucky. It’s about being smart and doing your homework before diving in headfirst.

In this blog post, I’m going to break it all down for you. I’ll show you exactly how to research a crypto project the right way.

Whether you’re a newbie or just looking to refine your strategy, this guide is your ticket to understanding the ins and outs of successful crypto investing.

By the time you finish reading, you’ll have all the tips, tricks, and strategies you need to spot those promising crypto projects and steer clear of any potential pitfalls.

IMPORTANT: I've selected some really great blog posts that I think you'll absolutely love. They're waiting for you right at the bottom of this post. Don't forget to give them a read!Why Research Matters in Crypto

Lots of newbies are attracted to crypto by the promise of quick profits, but without really understanding the projects they invest in, they may find themselves facing huge risks.

Here’s why research matters:

- Risk Mitigation: Crypto investments are inherently risky. By conducting research, you can identify and reduce potential risks associated with a specific project. This includes understanding the project’s goals, technology, and potential challenges it may face.

- Avoiding Scams and Frauds: The crypto space has seen its fair share of scams and fraudulent projects. Researching helps you distinguish between legitimate projects and those with malicious intent. Recognizing red flags early can protect you from falling victim to scams.

- Smart Decision-Making: Investing without proper research is akin to navigating uncharted waters blindfolded. Research lets you make clever choices based on a solid understanding of the project, the team behind it, and the tech it uses.

- Long-Term Success: Successful investing in cryptocurrencies is often a long-term game. Thorough research helps you identify projects with real-world potential and staying power. It positions you to hold onto your investments through market ups and downs and capitalize on long-term growth.

- Building Confidence: Confidence in your investments comes from knowledge. Researching a crypto project boosts your confidence by giving you the lowdown on the project’s basics and what makes it successful. This confidence helps you steer through the market, even when things get a bit rocky.

Step-by-Step Guide on How to Research a Crypto Project

Now that we’ve covered the why, it’s time to go into the how.

1. Start with the Whitepaper

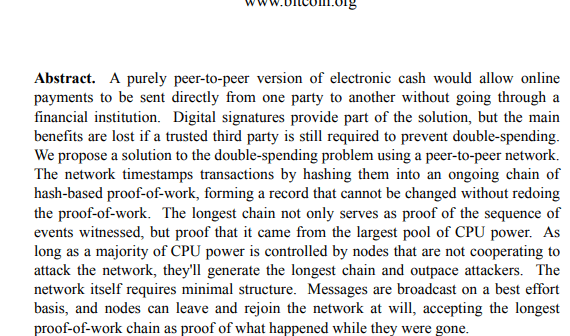

The whitepaper serves as the foundation of understanding any crypto project.

Think of it as a detailed introduction to a crypto project.

It’s the document that spills the beans on the problem the project wants to solve, how it plans to solve it, the technology behind it, and its future ambitions.

How to Read a Whitepaper

- Start with the Abstract: This is a brief summary of the entire document. It gives you an overview of what the project is about and what you can expect to find in the whitepaper.

- Understand the Problem Statement: Every project addresses a specific problem or inefficiency. The whitepaper should clearly articulate what this problem is and why it needs solving.

- Evaluate the Solution: Once you understand the problem, look into how the project proposes to solve it. Is the solution practical? Does it utilize blockchain technology effectively?

- Assess the Technology: Blockchain is at the core of most crypto projects. The whitepaper should explain how the project’s technology works and what makes it unique or innovative.

- Tokenomics: Many projects have their own native tokens. The whitepaper should outline the tokenomics – how tokens are distributed, their utility within the ecosystem, and any mechanisms for token issuance or rewards.

- Roadmap: A roadmap outlines the project’s timeline and milestones. It gives you a sense of the project’s development progress and future plans.

- Team and Partnerships: The whitepaper often introduces the team behind the project and any notable partnerships. Understanding the team’s experience and expertise is essential for assessing the project’s credibility.

Key Questions to Ask

- Does the project solve a real-world problem? Look for projects with clear use cases and practical solutions.

- Is the technology sound and scalable? A robust and scalable technology is essential for long-term success.

- Are the tokenomics fair and sustainable? Evaluate how tokens are distributed and whether the economic model makes sense.

- Does the team have the necessary experience and expertise? Trustworthy projects are transparent about their team members’ backgrounds.

2. Investigate the Team

In cryptocurrencies, the team behind a project is just as important as the idea itself. A good team can really make or break a project.

They bring credibility and increase the chances of success.

So, how can you check out the people behind a crypto project?

Let’s dive in:

Where to Find Information

First off, take a look at the project’s website and official channels. They usually have a section about the team.

Check out their bios, roles within the project, and links to their professional profiles.

How to Verify Team Members:

- LinkedIn Profiles: See if team members have active LinkedIn profiles. Check out where they’ve worked before, what they studied, and endorsements. Look for consistency between their claimed roles and responsibilities within the project.

- Online Presence: Search for team members’ names on professional networking platforms, social media, and online forums. If they’re involved in discussions and sharing useful stuff, that’s a good sign they’re committed.

- Past Projects and Achievements: Check if the team has been part of other successful projects in the crypto or tech world. Past wins and relevant experience suggest good things for the current project.

Red Flags to Watch Out For:

- Anonymity or Lack of Information: If a project keeps its team hidden or provides sketchy details, be wary. Trust is built on transparency.

- Inconsistencies or Misrepresentations: If there’s a gap between what the team says and what you can verify, that’s a sign something might be off. Watch out for exaggerated claims or overblown qualifications.

- Negative Reputation or Past Controversies: Conduct thorough research to identify any past controversies, legal issues, or fraudulent activities associated with team members. Reputation matters in the crypto community, and negative associations can harm the project’s reputation and investor confidence.

Read Also: How to Research Crypto Project Team Members Properly

3. Community Engagement

As a beginner looking to research a crypto project, understanding why community engagement matters is crucial.

Because crypto projects thrive on community support, enthusiasm, and active participation.

A vibrant and engaged community fosters trust, encourages adoption, and contributes to the project’s growth and resilience.

Where to Find Community Discussions:

- Explore various platforms where crypto communities gather to discuss projects, share insights, and exchange information:

- Social Media: Platforms like Twitter, Facebook, and LinkedIn host vibrant crypto communities where project updates, news, and discussions abound.

- Forums: Websites such as Bitcointalk, Reddit (subreddits like r/CryptoCurrency), and specialized crypto forums provide spaces for in-depth discussions, project announcements, and community feedback.

- Official Channels: Join official Telegram groups, Discord servers, or Slack channels established by the project team. These channels offer direct access to team members, announcements, and community-driven initiatives.

Assessing Community Sentiment:

- Pay attention to discussions, polls, and feedback from fellow investors and stakeholders. Positive sentiment and active engagement are indicators of a healthy and supportive community.

Red Flags to Watch Out For:

- Lack of Community Engagement: If a project’s community seems quiet or disinterested, it might struggle to gain traction. A vibrant community demonstrates investor interest and confidence in the project.

- Negative Sentiment and Concerns: Pay attention to red flags raised by the community, such as unresolved issues, controversies, or dissatisfaction with the project’s progress. Addressing community concerns transparently is essential for maintaining trust and credibility.

- Spam and Manipulative Practices: Beware of projects that engage in spammy or manipulative tactics to artificially inflate community engagement metrics. Real engagement comes from honest conversations and contributions, not spammy tricks.

4. Partnerships and Collaborations

Partnerships are strategic alliances formed between a crypto project and external entities, such as other projects, companies, or organizations.

These partnerships can boost the project’s reputation, help it reach more people, and open up new opportunities.

How to Verify Collaborations:

- Official Announcements: Check the project’s website, blog, or social media for announcements about partnerships. Legit projects usually give plenty of details about who they’re teaming up with and why.

- Press Releases: Find press releases or articles in trusted crypto news sources that confirm the partnership. If other news outlets are talking about it too, it’s more likely to be legit.

- Partner’s Confirmation: Verify the partnership from the perspective of the collaborating entity. Check if the supposed partner has acknowledged the collaboration through its official channels.

Assessing the Significance of Partnerships:

- Relevance to Project Goals: Check if the partnership helps the project reach its goals. Good partnerships should make the project grow.

- Credibility of Collaborators: Look at the reputation of the people or groups the project is collaborating with. If they’re reputable organizations or well-known industry figures, it’s a good sign.

- Impact on Adoption: See how the partnerships might affect how people use the project’s own coin or tech. Partnerships that make the project more visible or useful in the real world are usually a good thing.

Red Flags to Watch Out For:

- Unverifiable Partnerships: Be careful if a project claims partnerships without showing any proof. Legit projects are open about who they’re collaborating with.

- Exaggerated Claims: Be on the lookout for projects that make their partnerships sound bigger than they are. If they’re promising the moon or saying they have exclusive deals that sound too good, it might not be as legit as it seems.

5. Technology and Innovation

The technology underlying a crypto project is the engine that powers its innovation and functionality.

To figure out if a project is worth your attention, you don’t need to dive into super complicated details.

Let’s break down how you can check out a crypto project’s technology in a straightforward way:

Understand the Core Technology:

- Simple Explanation: Every crypto project is built on a specific technology, often a blockchain. Understand the basics of how this technology works and why it’s integral to the project.

- Example: If the project is built on Ethereum, know that it utilizes smart contracts for decentralized applications (DApps).

Scalability:

- Simple Explanation: Scalability refers to a project’s ability to handle growth without compromising performance. A scalable project can handle more users and transactions.

- Example: If a project claims to be scalable, ensure it has solutions in place to handle increased demand without slowing down.

Consensus Mechanism:

- Simple Explanation: Consensus mechanisms are the protocols that ensure all participants in a network agree on the state of the blockchain. Different projects use various mechanisms like Proof of Work (PoW) or Proof of Stake (PoS).

- Example: Bitcoin uses PoW, where miners solve complex mathematical problems to validate transactions.

Interoperability:

- Simple Explanation: Interoperability refers to a project’s ability to work seamlessly with other blockchain networks or traditional systems.

- Example: A project emphasizing interoperability might aim to facilitate smooth communication between different blockchains.

Open Source and Community Involvement:

- Simple Explanation: Open-source projects allow the public to view and contribute to the code. Community involvement enhances transparency and innovation.

- Example: A project with an active GitHub repository and a thriving developer community may indicate a healthy and transparent approach to technology development.

Upcoming Technological Developments:

- Simple Explanation: Stay informed about the project’s plans for future technological advancements. Projects that continuously improve their technology are more likely to stay relevant.

- Example: A project might have a roadmap that includes upgrades like the integration of new technologies or the enhancement of existing features.

Research Tools and Platforms

Fortunately, there are loads of helpful tools and places online to help you with your research into cryptocurrencies:

- Websites and forums: Platforms like CoinMarketCap, CoinGecko, and Reddit provide valuable insights, news, and discussions about various crypto projects.

- Crypto news outlets: Stay informed with reputable crypto news websites and blogs such as CoinDesk, and CoinTelegraph.

- Social media channels and groups: Join crypto communities on Twitter, Telegram, and Discord to interact with fellow enthusiasts and stay updated on project developments.

Additional Resources:

Excited to learn more about Bitcoin and cryptocurrencies? We’ve got some awesome resources below to help you out.

- How to Buy Cryptocurrencies Easily

- 5 Best Crypto Exchanges to Use

- How to Start Trading Crypto as a Beginner

- 20 Things You Should Never Do as a Crypto Investor/Trader

- Most Common Crypto Scams and How to Avoid Them

- 7 Best Ways to Secure Your Cryptocurrencies

- What to Check Before Buying a Cryptocurrency

And guess what? We’re also on Instagram and Twitter(X). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is intended for informational purposes only and should not be solely relied upon for making investment decisions. It does not constitute financial, tax, legal, or accounting advice. Additionally, I strongly recommend that you only invest in cryptocurrency an amount you are comfortable with potentially losing temporarily.