I want to share with you how to read crypto candlestick charts like a pro.

Candlestick charts can be intimidating at first, but once you understand how to read them, you’ll have a powerful tool at your disposal to help you make informed trading decisions.

In fact, understanding how to read crypto candlestick charts has become an essential skill for any crypto trader.

Crypto trading is a highly lucrative but also highly unpredictable venture.

As such, it’s crucial to equip yourself with the right tools and knowledge.

And one of the most important tools in any trader’s arsenal is the humble candlestick chart.

But why are candlestick charts so important, anyway?

Well, candlestick charts provide a wealth of information about market sentiment, price action, and more.

By learning how to read these charts, you can gain valuable insights into the psychology of the market, to know when to buy or sell crypto for profit.

So, whether you’re looking to trade Bitcoin, Ethereum, or any other cryptocurrency, understanding candlestick charts is a must.

And by the end of this post, you’ll have the knowledge and skills you need to start reading these charts like a pro.

So, let’s get started!

What is Candlestick in Crypto

In crypto trading, candlesticks are one of the most popular tools used to analyze the price movement of an asset.

They provide traders with a visual representation of how the price of a cryptocurrency has changed over a certain period.

Here’s an example of an actual Bitcoin-USD candlestick chart from Binance, the world’s largest crypto exchange.

Understanding Cryptocurrency Charts

Before we dive into how to read crypto candlestick charts, let’s first understand the candlestick.

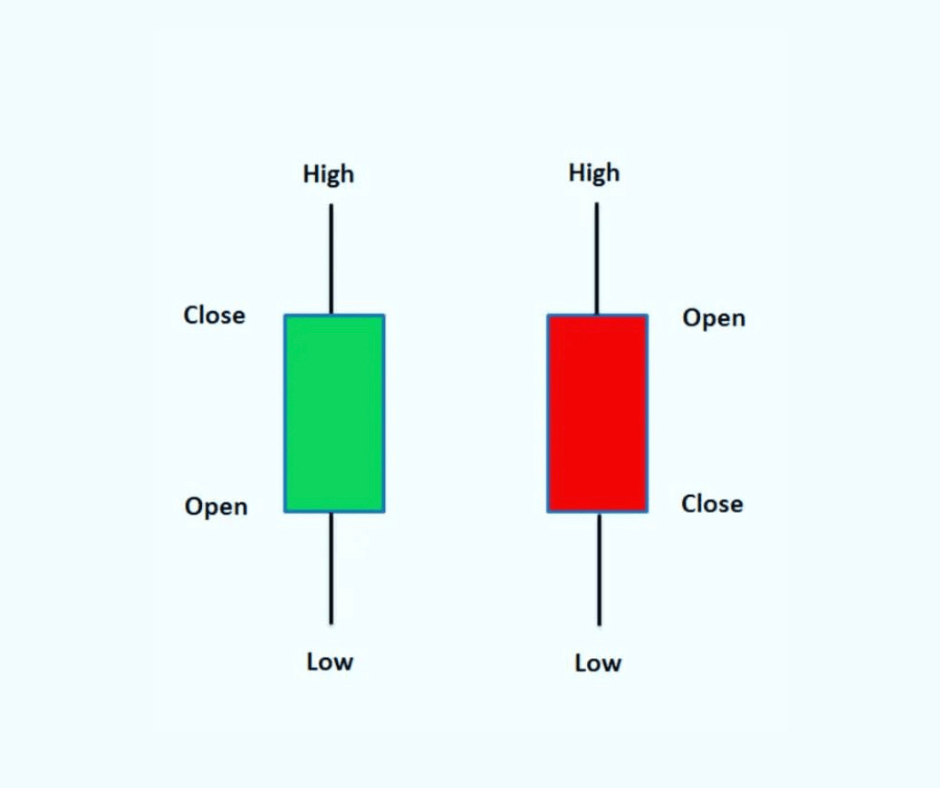

Each candlestick represents a specific timeframe, whether it’s minutes, hours, days, or weeks.

The body of the candlestick shows the opening and closing prices of the asset, while the wicks on either end represent the highest and lowest prices reached during that timeframe.

The color of the candlestick body can also provide valuable information.

In most charts, green or white candlesticks show prices going up, so the open is at the bottom of the body and the close is at the top, while red or black candlesticks show prices declining, so the open is at the top of the body and close is at the bottom.

Candlesticks can also be used to identify patterns that can help traders predict future price movements.

For example, a series of long green candlesticks can indicate a strong upward trend, while a series of long red candlesticks could indicate a downtrend.

So, candlesticks are an important tool for any crypto trader looking to make better decisions.

By learning how to read them and identify patterns, you can gain valuable insights into the market and potentially increase your profits.

Best Time Frame Candlestick for Crypto

Choosing the right time frame for your crypto candlestick chart is essential in making the right decisions.

Different time frames can provide different perspectives on the market, as a trader, you should choose the one that suits your trading strategy.

Here are some common time frames used in candlestick charts and their uses:

1. 1-Minute Chart

A 1-minute chart shows the price movement for each minute of the trading session.

It is commonly used by day traders who trade frequently and need to make quick decisions.

2. 5-Minute Chart

A 5-minute chart shows the price movement for each 5-minute interval of the trading session.

It is commonly used by day traders looking for short-term trading opportunities.

3. 4-Hours Chart

The 4-hour chart shows the price movement for every 4 hours of the trading session.

It is commonly used by swing traders looking for medium-term trading opportunities.

4. Daily Chart

A daily chart shows the price movement for each day of the trading session.

It is commonly used by swing traders and long-term investors who are looking for long-term trading opportunities.

Traders should choose the time frame that suits their trading strategy and the time they have available for analysis.

It’s important to note that using multiple time frames can provide a better overall view of the market and help traders make more informed decisions.

In the next section, we’ll cover how to read crypto candlestick charts in practice.

How to Read Crypto Candlestick Charts

Reading candlestick charts in practice involves analyzing patterns and trends to make informed trading decisions.

Here are some steps to follow when reading candlestick charts:

1. Identify the Time Frame

Identify the time frame that you want to analyze and adjust the chart accordingly.

Remember to choose the time frame that suits your trading strategy.

2. Look for Trends

Look for trends in the market by identifying the direction of the candlesticks.

Bullish candlesticks indicate an upward trend, while bearish candlesticks indicate a downward trend.

3. Analyze Candlestick Patterns

Analyze the candlestick patterns to identify potential trend reversals or continuations.

Pay attention to patterns such as doji, hammer, hanging man, shooting star, and inverted hammer.

4. Use Technical Indicators

Use technical indicators to confirm or deny the candlestick patterns.

Indicators such as moving averages, and relative strength index (RSI) can provide valuable insights into the market trends.

5. Identify Key Levels

Identify key support and resistance levels on the chart to determine potential entry and exit points.

By following these steps, traders can gain valuable insights into the market and make informed trading decisions.

It’s important to note that candlestick charts should not be used in isolation and should be used in combination with other technical analysis tools to make the most informed decisions.

Where can I Get a Candlestick Chart for Crypto

If you’re interested in getting a candlestick chart for crypto, there are several options available to you.

One of the most popular sources for crypto candlestick charts is Tradingview.

It’s a free platform that allows you to view candlestick charts for various cryptocurrencies, as well as many other trading instruments.

To get started, simply visit tradingview.com and create a free account.

Once you’re logged in, you can search for the cryptocurrency you’re interested in and select the candlestick chart option from the chart type menu.

This will display a candlestick chart for the selected cryptocurrency, which you can customize according to your preferences.

If you’re using a crypto exchange, you may also be able to view candlestick charts directly on the exchange platform.

For example, popular exchanges like Binance, Bybit, Kucoin, and Gate.io all offer candlestick charts for the cryptocurrencies they support.

Here’s another example of an Ethereum-USD candlestick chart from Bybit.

How to Read Crypto Candlesticks Patterns

Candlestick patterns are formed by a combination of candlesticks, and they provide valuable information about market trends and price action.

Here are some common candlestick patterns and what they indicate:

1. Bullish and Bearish Candlesticks

Bullish candlesticks are those that close higher than their opening price, indicating that buyers were in control during that time frame.

Bearish candlesticks, on the other hand, close lower than their opening price, indicating that sellers were in control.

[READ: What is A Bull Market in Crypto? A Beginner’s Guide]

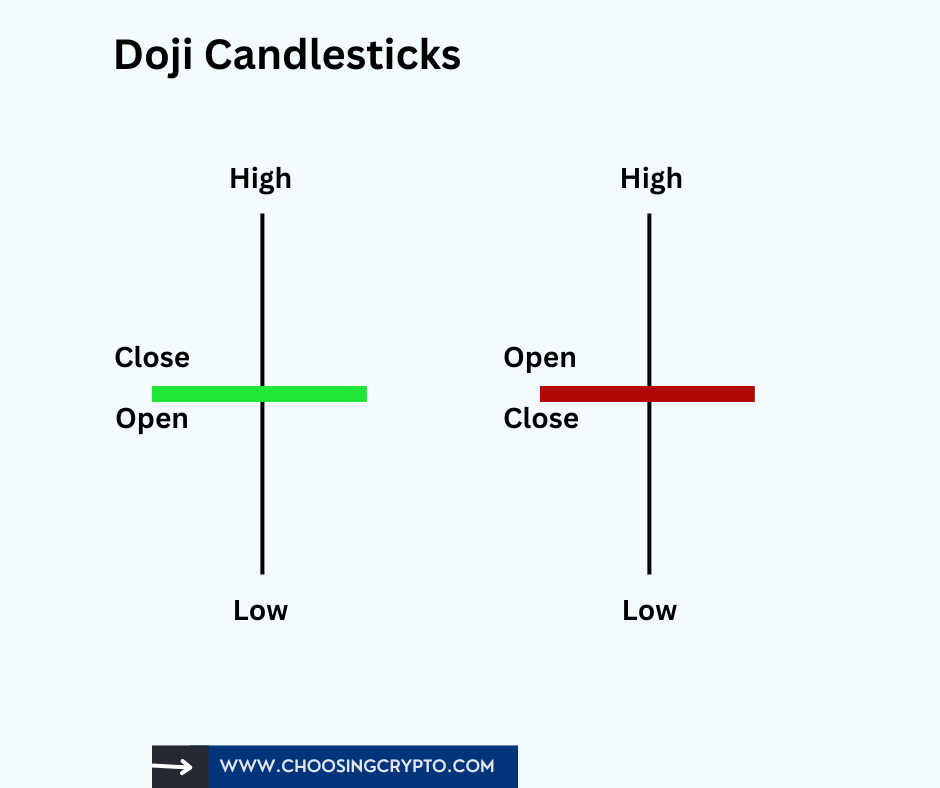

2. Doji Candlesticks

Doji candlesticks occur when the opening and closing prices are the same or very close to each other.

They indicate a state of indecision in the market and can be a sign of a potential reversal.

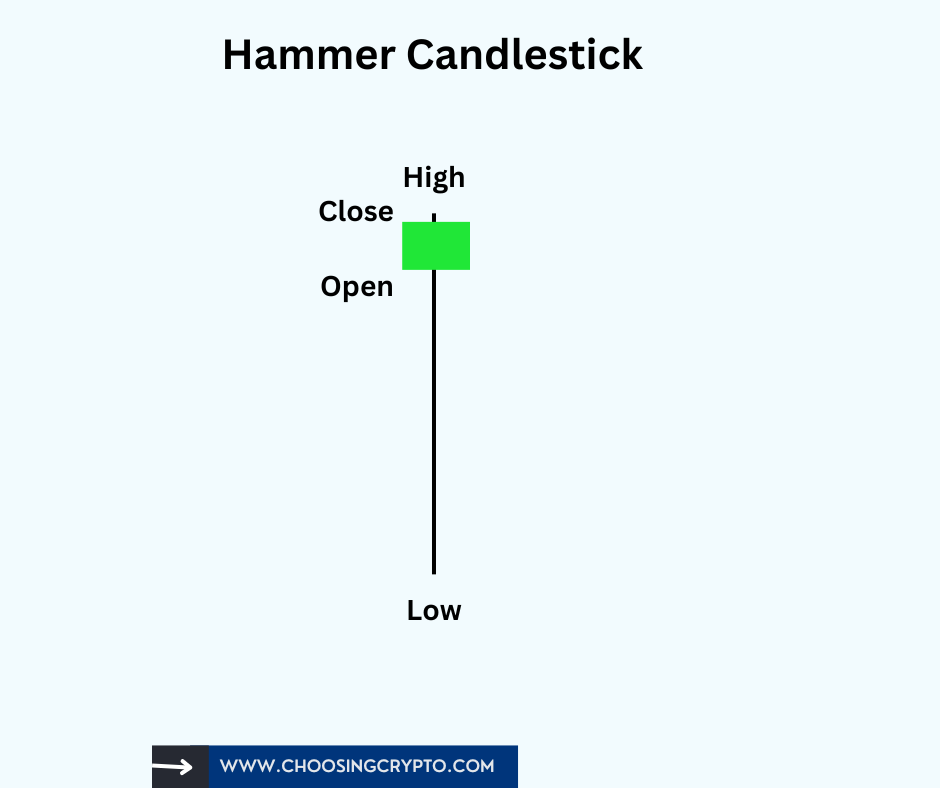

3. Hammer and Hanging Man Candlesticks

Hammer and hanging man candlesticks have long lower tails and small or nonexistent upper tails.

They indicate a potential reversal from a bearish to a bullish trend.

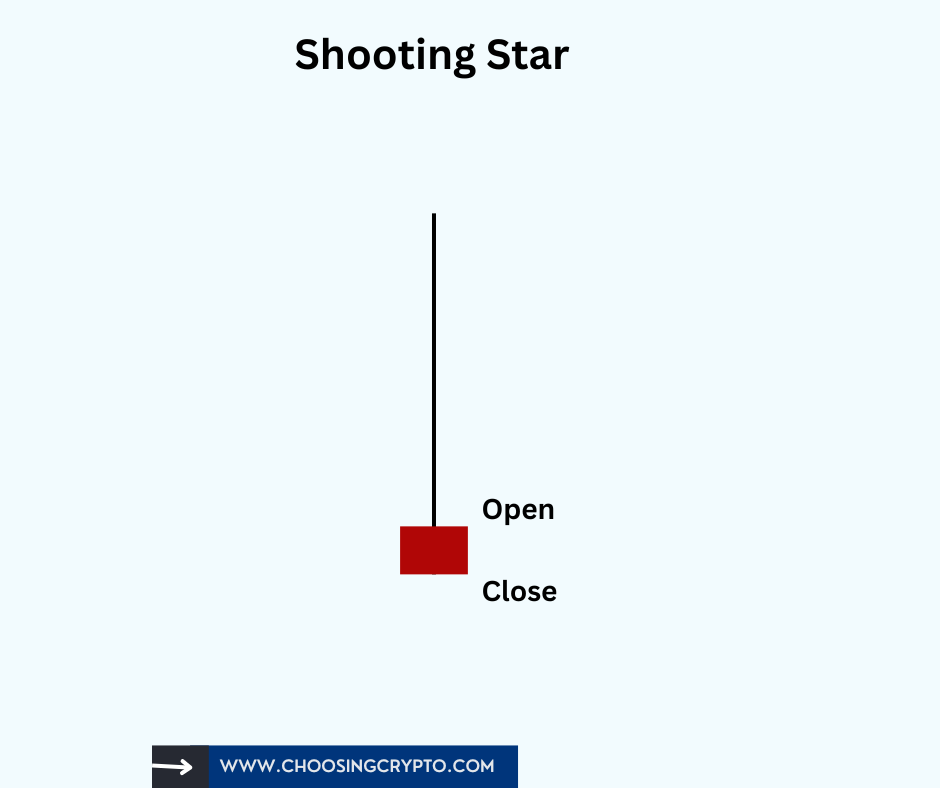

4. Shooting Star and Inverted Hammer Candlesticks

Shooting star and inverted hammer candlesticks have long upper tails and small or nonexistent lower tails.

They indicate a potential reversal from a bullish to a bearish trend.

These candlestick patterns can give traders insights into market trends and future actions.

Pros and Cons of Using Crypto Candlestick Charts

Here are some of the pros and cons of using crypto candlestick charts:

Pros:

1. Easy to read: Candlestick charts are easy to read and interpret, even for beginners.

The use of colors and shapes makes it easy to identify trends, support, and resistance levels.

2. Provide more information: Candlestick charts provide more information than other types of charts.

They not only show the opening and closing price of an asset but also the high and low prices for the period, allowing traders to identify patterns and make good decisions.

3. Can be used for different timeframes: Candlestick charts can be used for different timeframes, from minutes to months.

This flexibility makes them suitable for traders and investors with different investment horizons.

4. Can be used for different assets: Candlestick charts can be used to analyze a wide range of assets, including stocks, currencies, and commodities.

This makes them versatile tools for traders and investors.

Cons:

1. Can be subjective: The interpretation of candlestick charts can be subjective.

What one trader sees as a bullish pattern, another trader may see as a bearish pattern.

2. Maybe less useful in some markets: Candlestick charts may be less useful in markets that are less liquid or have low trading volumes.

In these markets, price movements may be more erratic, making it difficult to identify patterns.

3. Historical patterns may not repeat: While candlestick charts can provide useful insights into the behavior of an asset, historical patterns may not always repeat in the future.

Traders should use candlestick charts in conjunction with other tools to make a much better decision.

4. May be too complex for some: Candlestick charts may be too complex for some traders, particularly those who are new to technical analysis.

They may find it difficult to understand the different patterns and what they indicate.

In such cases, it may be helpful to start with simpler charts and gradually work up to candlestick charts.

Conclusion

And that’s it, folks!

You made it to the end of our guide on how to read crypto candlestick charts.

By now, you should be feeling confident in your ability to interpret the different patterns and signals these charts provide.

You should be ready to put your newfound skills to the test.

Remember, practice makes perfect, so keep honing your skills by studying different charts and monitoring market trends.

I hope that this guide has helped demystify the crypto candlestick charts.

If you have any questions or feedback, don’t hesitate to reach out to us.

Happy trading!

I have also written some other crypto blog posts that will help you in your cryptocurrency journey.

Check them below.

You should also check us out on Twitter and Instagram to follow us and stay up-to-date with the industry.

read also:

- How to Use Candlestick Charts to Identify Trading Opportunities in The Crypto Market

- 7 Common Mistakes Crypto Investors and Traders Make

- Most Common Crypto Scams and How to Avoid Them

- 5 Best Crypto Exchanges For Trading Cryptocurrencies

- Why You Keep Losing Money in Crypto

IMPORTANT; you must never send money to anyone you meet online asking to help you invest in cryptocurrency. They are scammers. Crypto is easy, and you can do it all by yourself.

DISCLAIMER:

The information presented here should not be used as the sole basis of any investment decisions, nor should it be construed as financial, tax, legal, or accounting advice. I will also advise that you invest in cryptocurrency only what you are comfortable living without, at least temporarily.

[READ: 7 Top Ways to Secure Your Cryptocurrency From Being Stolen]