2022 was not an interesting year for crypto traders and investors worldwide.

Instead, it was a year to forget.

The bull market of 2021 turned bearish at the very end of the year, taking Bitcoin’s price from $47,586 in January 2022 down to $15,479 in November 2022.

And whether the bear market is over or not, only time will tell.

But that was a crash no one expected, yet it happened.

Just like in 2011, 2013, 2015, 2017, and 2021 when we had big crashes in the crypto market.

Check out the biggest Dip in Bitcoin history.

But in every failure, there is always an opportunity, and that is what I want to share with you in this post, the big lessons everyone should learn from these events that moved the market negatively.

Because if you lost money in 2022, it will be a big mistake to repeat the same mistakes that cost you money.

Big Events that Moved the Crypto Market and Lessons to Learn

Event; TerraUSD collapse

TerraUSD also called UST was the third-largest stablecoin in the world with a market cap of around $18 billion before its sudden collapse.

As a stablecoin, UST was supposed to maintain a $1 peg, like other stablecoins, and not collapse like meme coins.

It was something no one would expect to see because stablecoins are like a safe haven for investors and traders.

When investors expect a hit in the crypto market, they put their money into stablecoins to protect their assets.

They are supposed to maintain a fixed value, usually equivalent to the U.S. dollar, which is why people trust them.

But UST lost its $1 peg, evaporating the life savings of investors worldwide.

What to Learn

You should not trust all stablecoins, after all, stablecoins can collapse too.

So, to be safe, you must be careful when choosing your stablecoin.

It is better to be safe than sorry.

Pro tip: choose a stablecoin that is backed by actual U.S. dollars that are held in reserve.

[READ: Best Stablecoins to Use]

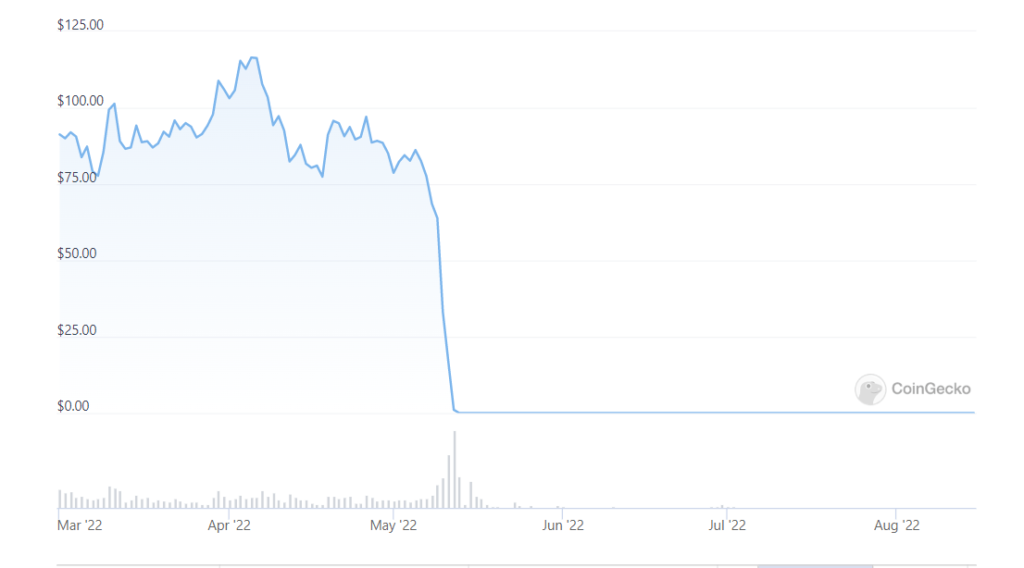

Event; Luna Crash

The Luna crypto crash was caused by its connection to UST (the above-mentioned stablecoin)

But that’s another crypto crash that no one saw was coming because Luna was doing fine.

In fact, the Luna coin went from being worth less than $1 in early 2021 to an ATH of $119 on April 5th, 2022, and the coin created many crypto millionaires within a year.

This made people bullish on Luna, expecting it to continue to soar high.

But that never happened, instead Luna crashed with UST, dropping to a fraction of a penny, and people lost their life savings.

What to Learn

Apart from Bitcoin, no other cryptocurrency is too big to fall. Not even Ethereum.

Know this and know peace.

So, when thinking of how much you will make, think also about how much you could lose.

Pro tip: don’t invest more than you are willing to lose.

[READ: 7 Hard Lessons from The Crypto Crash]

Event; FTX Collapse

The collapse of FTX was another loud event in 2022.

Before their collapse, FTX was one of the largest crypto exchanges in the world.

They were heavily promoted everywhere by the biggest celebrities and influencers, making it easier for them to win the trust of millions of people in the crypto world.

Even its founder, Sam Bankman-Fried (SBF), created a public image that portrays him as a selfless man and one of the most generous billionaires in the world.

He continued to drive a Corolla even as a billionaire and promised to give away billions of dollars.

He even said the only reason he started FTX was to make money to give it away.

But no one knew what was going on behind the scenes. No one knew the crypto exchange was mismanaging customers’ funds.

However, the hidden became obvious, causing the crypto exchange to collapse.

What to Learn

Most celebrities and influencers promote products and services to make money.

They don’t do background checks, and that is enough reason not to trust whatever they promote.

You should also be careful with your choice of crypto exchange.

You don’t have to wait for your current crypto exchange to collapse, and you don’t have to wait to lose your funds before choosing a trusted exchange.

To be safe, you should transfer your cryptocurrencies to a hardware wallet.

You can also check out my recommended crypto exchanges to pick a trusted crypto exchange.

So many exchanges have collapsed in the past, and many more that are mismanaging customers’ funds will collapse in the future.

Pro tip: leave only the cryptocurrencies you are trading with on an exchange.

Conclusion

Investing in cryptocurrency can be highly profitable, but it comes with high risks that you must accept.

The industry is currently suffering from a gross lack of regulation, market manipulation, hacks, thefts, and lack of transparency.

So many other big crypto companies like 3AC, Voyager, Celsius, and BlockFi also collapsed in 2022.

This is not a post to scare you away from investing in crypto, but a post encouraging you to invest wisely.

Check out other posts from us below.

But before that, follow us on Twitter and on Instagram.

[READ: Best Crypto Hardware Wallet for Storing Crypto Offline]

[READ: Common Mistakes Crypto Investors and Traders Make]

IMPORTANT; you must never send money to anyone you meet online asking to help you invest in cryptocurrency. They are scammers. Crypto is easy, and you can do it all by yourself.

DISCLAIMER:

The information presented here should not be used as the sole basis of any investment decisions, nor should it be construed as financial, tax, legal, or accounting advice. I will also advise that you invest in cryptocurrency only what you are comfortable living without, at least temporarily.