Are you looking for the next big crypto that could change your life? If yes, you should also know what to check before buying a cryptocurrency.

At least to avoid mistakes that will lead to losses.

Because, with the increasing popularity of cryptocurrencies, and the potential for high returns, the allure of investing in a new cryptocurrency can be strong.

And with paid social media influencers always hyping new coins as the next big thing, it can become even worse.

This is why many investors buy cryptocurrencies without any research.

However, the reality is that new cryptocurrencies are being introduced every day.

Sadly, all these cryptocurrencies are not created equal, and investing without careful consideration can lead to significant financial losses.

So, in this guide, we’ll discuss the essential factors to consider before buying cryptocurrency.

To give you the knowledge you need to avoid investing your hard-earned money into worthless coins.

This post will empower you to make informed decisions that will minimize your risks and maximize your chances of success.

What to Check before Buying a Cryptocurrency

These are important things to consider before buying a new crypto coin.

1. Check the whitepaper

The first thing you should do is read the project’s whitepaper.

A crypto whitepaper is a detailed document that outlines a new cryptocurrency.

It serves as a way for the project’s creators to share their vision, goals, and technical specifications with potential investors, partners, and the wider crypto community.

Whitepapers can range in length from a few pages to over 100 pages, depending on the complexity of the project and the level of detail provided.

A typical crypto whitepaper will include the following sections:

- Introduction: This section provides an overview of the project and its goals.

- Problem Statement: This section outlines the problems the project aims to solve.

- Solution: This section provides a detailed explanation of the project’s solution to the problems outlined in the previous section.

- Tokenomics: This section explains how the project’s native token works, including its purpose, how it will be distributed, and how it will be used within the ecosystem.

- Roadmap: This section provides a timeline of the project’s development, including key milestones and targets.

- Team: This section provides information about the project’s team, including their background, experience, and credentials.

However, it’s important to remember that a whitepaper is just one part of the due diligence process, and investors should always conduct additional research.

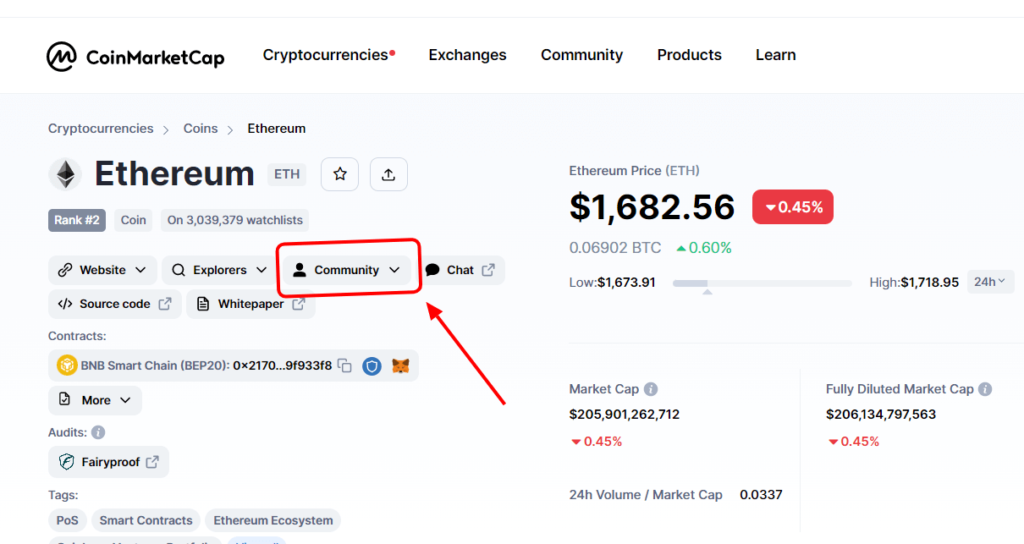

You can find a crypto whitepaper on their official website or cryptocurrency price tracking websites such as CoinMarketCap.

2. Check social media presence

A crypto project’s social media presence can provide valuable insights into the project’s team, community, and potential for success.

However, investors should evaluate a project’s social media presence carefully and look beyond just the number of followers, as fake followers can be bought.

Here are some key factors to consider:

- Frequency of Posts: A crypto that regularly posts updates and engages with its community is more likely to be committed to its project.

- Quality of Content: The quality of a project’s social media content can provide insight into the level of professionalism and expertise of the project’s team.

- Community Engagement: A strong and engaged community can indicate that the project has a committed following and a supportive community.

- Social Media Following: While a large following does not necessarily indicate the legitimacy of a project, it can provide insight into the level of interest in the project.

- Response to Feedback: A project that responds to feedback and addresses concerns raised by its community can indicate that the team is committed to listening to its community.

To find the social media account of a crypto, visit CoinMarketCap, search for the crypto, and go to community.

3. Check the team behind the crypto

The success or failure of a cryptocurrency is dependent on its team members.

Therefore, it is important to assess the team before you buy a new coin.

Here are a few reasons why it is important to consider the team and leadership before buying a new crypto:

- Expertise and Experience: The team behind a cryptocurrency project should have a high level of expertise and experience in relevant areas, such as blockchain technology, software development, and finance. A strong team can ensure that the project is technically sound and capable of delivering on its promises, while a team entirely new to the crypto community might not have the experience to achieve its goals.

- Risk Mitigation: Investing in a cryptocurrency project is inherently risky, and a strong team and leadership can help to mitigate those risks. For example, they can respond effectively to regulatory changes or market fluctuations and adjust the project’s direction accordingly.

Team members of a crypto project can be found on the project’s website.

You can find a crypto project website on CoinMarketCap.

Once you have identified the team members, you can research their backgrounds and experience to assess their qualifications and expertise.

[READ ALSO: How a New Bitcoin is Created]

4. Check the token supply

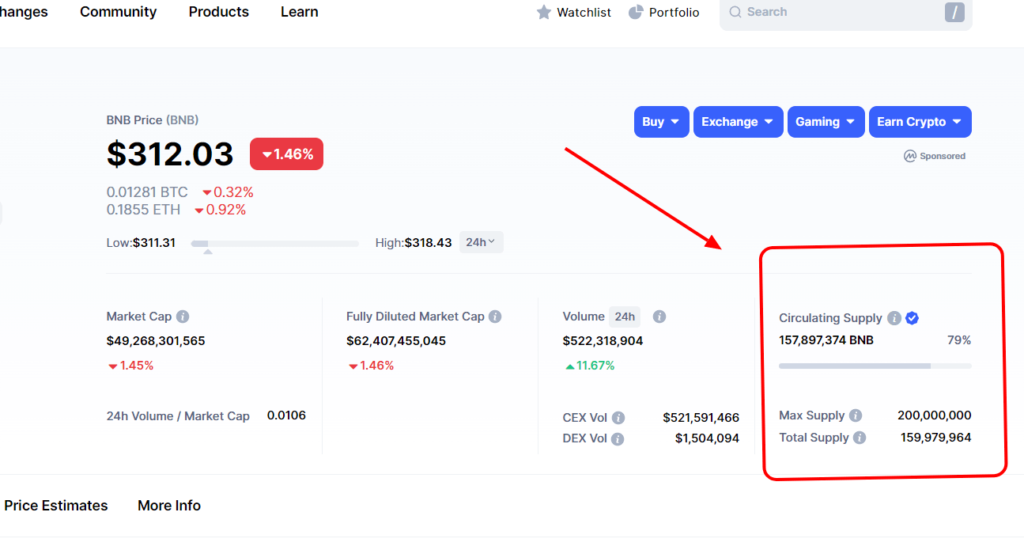

Token supply refers to the total number of coins that will be created and made available to users.

It is an important factor to consider when choosing a cryptocurrency to invest in because it can have a significant impact on the potential scarcity and value of the project.

For example, if a coin has a maximum supply of 200 million coins, but the circulating supply is 50 million coins, this means 150 million coins still have to be dropped on the market.

This could negatively affect the long-term value, which is why you have to take it into consideration.

Here are some key things to keep in mind when considering token supply:

- Maximum Supply: This is the maximum number of tokens that can ever be created for the project. This is important because it can help to prevent inflation.

- Circulating Supply: This is the number of tokens currently in circulation and available for trading on exchanges. This number can change over time as tokens are mined or distributed to users.

- Token Burning: Some blockchain projects burn tokens to reduce supply and increase the value of remaining coins. This can be a positive sign for investors, as it shows that the project is actively working to increase the value of its token.

To find the supply of a crypto visit CoinMarketCap, search the crypto, and check the circulating supply and maximum supply.

5. Check the use case of the crypto

Use cases in crypto refer to the practical applications of cryptocurrencies and blockchain technology beyond their use as a medium of exchange or investment.

Here are a few examples of use cases in crypto:

- Decentralized Finance (DeFi): DeFi applications are built on blockchain technology and aim to provide financial services such as lending, borrowing, and trading in a decentralized and transparent manner, without the need for traditional financial intermediaries. DeFi has the potential to provide greater financial inclusion and autonomy to individuals and businesses globally.

- Identity Management: Blockchain technology can be used to create decentralized identity systems that allow individuals to control their personal information and authenticate their identity in a secure and privacy-preserving manner.

- Gaming and Entertainment: Cryptocurrencies and blockchain technology can be used to create decentralized gaming and entertainment platforms, with in-game assets and transactions secured on the blockchain. This has the potential to provide greater ownership and control of in-game assets and enhance the gaming experience.

These are just a few examples of the diverse and evolving use cases for cryptocurrencies.

Note: A coin that has a specific use case and solves a problem has more chances of success than one without real-world usability.

[READ: The Minimum Amount to Start Investing in Bitcoin]

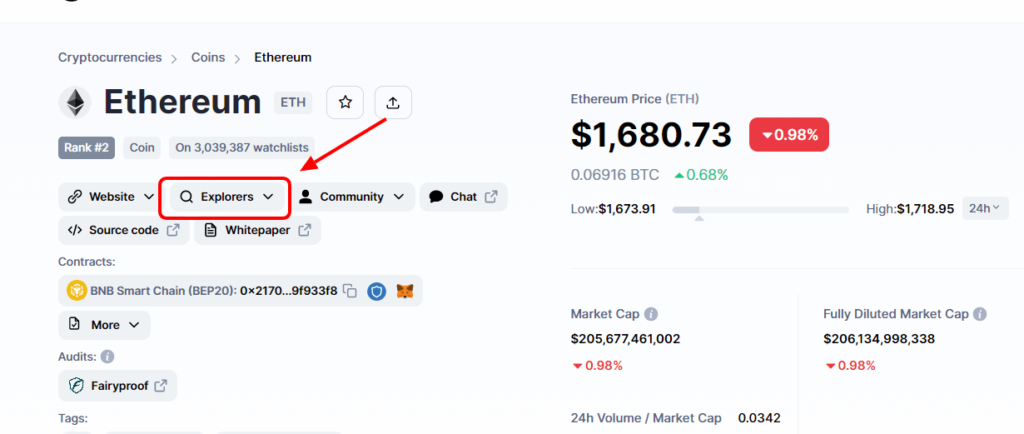

6. Check how many holders the coin has

Knowing the number of holders of a cryptocurrency can give you an idea of the level of adoption and interest in the project.

Generally, the more holders a cryptocurrency has the more popular and established it is likely to be.

Successful cryptocurrencies often have more than 500,000 active holders, but new coins will have less than that.

Here are a few reasons why you might want to check the number of holders before investing:

- Market Confidence: A high number of holders can indicate that there is a significant amount of confidence in the project and its growth potential. This can help to attract more investors and increase demand for the cryptocurrency.

- Liquidity: A large number of holders can help to improve the liquidity of a cryptocurrency, making it easier to buy and sell on exchanges. This can be particularly important if you need to sell your investment quickly in the event of a price drop or other unforeseen circumstances.

- Stability: A large and diverse group of holders can help to stabilize the price of a cryptocurrency, as there is less risk of a single large holder or group of holders manipulating the market.

To find the number of holders a coin has, visit CoinMarketCap, look for the crypto, then click on “Explorers“.

7. Check token distribution

Token distribution refers to how the tokens of a particular cryptocurrency are distributed among its users and stakeholders, including investors, developers, founders, and advisors.

It is also a crucial factor to consider when investing in a new cryptocurrency.

This is because if a large percentage of the tokens are held by a small number of people, it can create the risk of market manipulation and price volatility.

Here are a few reasons why token distribution is important:

- Decentralization: A well-distributed token supply can indicate a higher degree of decentralization in the project, meaning that power and decision-making are spread out among a larger number of people. This can help to reduce the risk of centralization and increase the resilience of the project.

- Fairness: A fair and transparent token distribution can help to attract more investors and increase the overall trust in the project.

- Incentives: The token distribution can also influence the incentives of various stakeholders. For example, if the team and founders hold a large percentage of the tokens, they may be more focused on short-term gains rather than the long-term success of the project. On the other hand, if the tokens are well-distributed among various stakeholders, it can encourage long-term investment and commitment.

You should look for projects that have a fair and equitable token distribution.

8. Check market Capitalization and Volume

The market capitalization and trading volume are also essential metrics to consider when investing in a new cryptocurrency.

Market capitalization represents the total value of all the coins or tokens in circulation, while the trading volume represents the total number of coins or tokens that have been traded in a specific period.

Higher market capitalization and trading volume indicate greater liquidity and a more stable market, reducing the risk of sudden price fluctuations.

They are less risky than cryptocurrencies with smaller market capitalization and trading volume.

[READ: How to check the Market Cap of a Crypto]

9. Check overall market trends

The overall market trends are another important factor to take into consideration before you buy a new crypto.

The cryptocurrency market is known for its volatility, and overall trends can provide valuable information about the direction of the market as a whole.

For instance, if the market is trending upwards, it may be a good time to invest in a cryptocurrency.

Conversely, if the market is trending downward, it may be wise to hold off on investments until the trend changes.

Investors who understand the overall market trends can better time their entry into the market, allowing them to take advantage of upward trends and avoid entering during bearish trends.

Conclusion

These are some of the things to check before buying a new cryptocurrency.

They are what separate successful crypto investors and unsuccessful investors, and it is better to take time and check them out.

Sadly, some investors don’t do any of these.

Instead, they depend on social media influencers who are often paid to promote new coins as the next big crypto.

This is why they end up investing in cryptocurrencies that lose value over time.

I hope you found the post helpful.

Kindly share it with your friends and follow us on Twitter and on Instagram.

You should also check out other content from us below to learn and understand Bitcoin and the cryptocurrency market better.

read also:

- 5 Best Crypto Exchanges to Buy Cryptocurrencies

- How to be Successful in Cryptocurrency

- Important things to Know Before Investing in Cryptocurrency

IMPORTANT; you must never send money to anyone you meet online asking to help you invest in cryptocurrency. They are scammers. Crypto is easy, and you can do it all by yourself.

DISCLAIMER:

The information presented here should not be used as the sole basis of any investment decisions, nor should it be construed as financial, tax, legal, or accounting advice. I will also advise that you invest in cryptocurrency only what you are comfortable living without, at least temporarily.