Are your crypto habits secretly killing your profits?

One day you’re up, the next you’re questioning every decision you’ve made. It’s not always the crypto market; sometimes it’s the hidden habits you don’t even notice. These small mistakes can drain your gains and slow your growth. The good news? Once you spot them, you can fix them fast.

In this post, you’ll learn about seven common mistakes that crypto investors and traders make daily without even realizing it. Catching them early could mean the difference between being successful or unsuccessful.

New to crypto? I offer beginner-friendly 1-on-1 coaching, and your first session is free. Check it out here.

Seven Common Mistakes Crypto Investors and Traders Make

These are some common crypto mistakes you should avoid. Don’t miss number 5.

1. Not Knowing Whether You’re Trading or Investing

This is the root mistake most people in crypto don’t even realize they’re making. You buy a coin planning to hold it long term, then panic and sell when it drops. Or you entered into a trade for quick profit, but ended up holding for months.

If that sounds like you, stop and ask yourself: Am I investing or trading?

Too many people get into crypto without being clear on what they’re trying to do. Investing is about long term growth. Trading is about short term profits. Mixing the two without realizing it is one of the biggest silent killers of success in crypto. It leads to losses that don’t make sense and constant frustration.

So, before you even think about profits in crypto, or coins to buy, take a moment to get honest with yourself. Knowing whether you’re trading or investing isn’t just a small detail. It’s the foundation of everything you do in crypto.

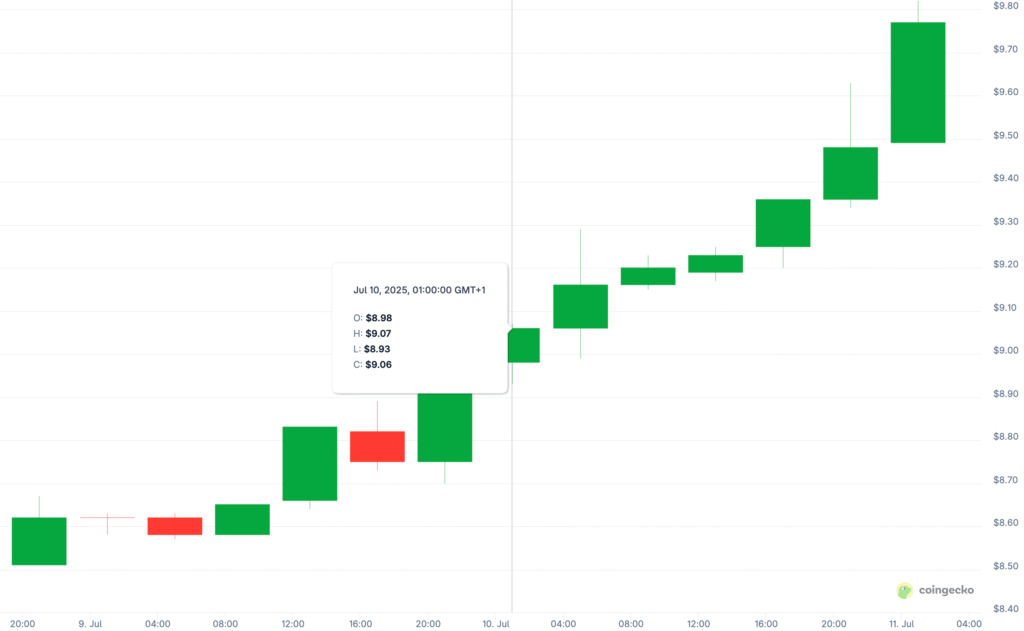

2. Chasing “Green Candles” Without Context

Almost everyone in crypto has made this mistake. You open your app and see a coin pumping +15%, +50%, maybe more. Yesterday, you weren’t thinking about this coin. Today, you feel like if you don’t buy now, you’ll miss out.

So you buy, hoping to catch more of the rise. But by the time you see that green candle, you’re often already late.

You’re buying where someone else is selling, not their entry. This isn’t how you win in crypto. That’s how people lose money fast and then say crypto is a scam.

In crypto, green doesn’t always mean go. Sometimes it means stop and think. What’s driving the price? Find out why it’s rising before you decide if it’s worth it.

If you’re buying just because it’s going up, you’re not investing. You’re chasing, and chasing is gambling.

Make this your rule: If the only reason you’re buying is because the price is already rising… stop.

3. Forgetting to Take Profits

Not taking profits is one of the most common and costly mistakes that crypto investors and traders make.

Many people have been up in crypto 200%, even 500%, only to watch it all vanish, until it’s the original investment that remains, or worse, sitting at a loss. I’ve seen someone turn $10K into $40K, and watched it crash to $3K. Why? No profit plan.

This isn’t about selling too early. It’s about protecting what you’ve already earned. There’s a reason experienced traders say, “You don’t go broke taking profits.” You go broke waiting too long to take them.

You don’t have to sell everything, but you do need a plan. Because if you don’t choose when to take profits, the market will take them from you.

Smart investors don’t just think about when to buy. They know when to walk away with the win.

You May Like: 5 Best Ways to Take Profits in Crypto Without Regret

4. Overexposing to a Single Crypto Sector

One of the reasons many investors suffer in crypto is that they think they’re diversified when they’re not. Holding five or six coins isn’t true diversification if they all belong to the same sector, like DeFi, Layer 2, AI, or gaming.

I had a client in my crypto coaching program who thought the same, until every single coin of his dropped 60% in a week.

This mistake isn’t always obvious because most people don’t realize crypto has sectors. Someone might buy Uniswap, Aave, Synthetix, and Curve, thinking they’re diversified, but they all depend on success of DeFi. If something goes wrong in that sector, whether from regulation, a hack, or lost interest, everything can crash together.

In crypto, money moves in trends. This time it’s gaming. Next, it’s AI. Then Layer 2s. If you want to grow and survive in crypto, don’t just buy different coins. Buy coins from different sectors.

Real profits don’t come just from what you buy, but from how well you’re protected when things go wrong.

5. Assuming All Crypto Exchanges Are Equally Safe

This is one of the worst mistakes crypto investors and traders make. Some don’t just lose profits, they lose everything.

People assume that if an exchange looks professional or is popular online, it must be safe. But that’s far from the truth. Not all exchanges are equally safe. Some are just well marketed traps with zero protection when things go wrong.

FTX is a painful example. It was one of the most trusted names in crypto, had celebrity endorsements, and sponsored sports arenas. But behind the scenes, it was misusing customer funds. When it collapsed, over $8 billion vanished. Users didn’t lose because they bought bad coins. They lost because they trusted the wrong platform.

And FTX wasn’t the only one. Mt. Gox, Cryptopia, QuadrigaCX, and others failed too.

This mistake is the reason some walked away from crypto entirely. Not because the market failed them, but because they put their trust in the wrong place.

That’s why I always tell my crypto coaching clients to stick with exchanges that have proven themselves over time. Platforms like Binance, Bybit, and Gate.io have built a consistent reputation for reliability and user protection.

6. Using the Wrong Stablecoin Without Verifying Trustworthiness

Stablecoins are meant to be the safe zone in crypto. You take profits, move them into a stablecoin, and wait. But not all stablecoins are actually safe. Some are backed by real reserves and are audited transparently. Others rely on risky systems or nothing at all.

One of the most painful examples was TerraUSD (UST). It was once a top three stablecoin by market cap. It promised stability, gained massive trust, and was used by millions. But in just days, it collapsed, wiping out over $40 billion. People who thought they had moved their money into something safe watched it all go to zero. Not from bad trades, but from trusting the wrong stablecoin.

And it wasn’t just UST. Others have failed, some without making headlines.

So, if you’re using stablecoins to protect your profits, trade between coins, or store money, ask what backs them. Is it cash? Is it audited? Who controls it? Can it depeg under pressure?

Choosing the wrong stablecoin isn’t a small mistake. It can wipe you out.

You May Like: Safest Stablecoins to Use

7. Refusing to Admit They Were Wrong

One of the most damaging mistakes crypto investors and traders make is refusing to admit when they’re wrong. It seems minor, but it’s often what turns a 15% dip into a 90% crash. Not because they lacked knowledge, but because they let pride take over.

You see it all the time. People still hold coins from 2021 that haven’t moved in years, clinging to hope they’ll recover.

Refusing to admit you’re wrong blocks your growth. If you can’t acknowledge mistakes, you won’t learn. So, you keep making the same errors with different tokens and trades, again and again.

The best traders aren’t the ones who are always right; they’re the ones who are quick to recognize when they’re wrong.

So ask yourself: are you holding something because it could still bounce, or simply because you don’t want to admit you were wrong?

If that question feels uncomfortable, it’s meant to. That discomfort is your wake-up call.

Want personal help with crypto? I offer 1-on-1 coaching, and your first session is free. Book your free session here.

Additional Resources:

- Safest and Most Trusted Crypto Exchanges to Use Now

- Important Things to Know Before Investing in Cryptocurrency

- How to Secure Your Crypto from Being Stolen

And guess what? We’re also on Instagram and X (Twitter). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is for informational purposes only. Do not rely solely on it for making investment decisions. It is not financial, tax, legal, or accounting advice. Always do your own research or consult a financial advisor before investing in cryptocurrency.