You’ve probably heard the word “liquidity” thrown around in crypto trading. But what is liquidity in crypto trading, and why should you bother knowing about it?

Well, let me be your guide through the maze of liquidity in crypto trading.

But before we go into the details, let me assure you that understanding this idea isn’t just for experienced traders. No, it’s for YOU – the beginner keen on getting a piece of the crypto action.

In this journey, I’ll unravel the mystery of liquidity, talk about why it’s important in crypto trading, and give you the know-how to navigate the markets like a champ.

So, get ready for an adventure that will leave you informed, confident, and all set to take on the crypto market!

IMPORTANT: I've selected some really great blog posts that I think you'll absolutely love. They're waiting for you right at the bottom of this post. Don't forget to give them a read!What Does Liquidity Mean in Crypto Trading?

Liquidity is basically how easy it is to buy or sell something without drastically changing its price.

Picture this: if you’re trying to sell your old bike and lots of people want to buy it at a fair price, you’d say your bike has good liquidity. But if no one’s interested or the offers are way too low, your bike has low liquidity.

Now, in crypto trading, liquidity works pretty much the same way. It’s about how easily you can buy or sell a cryptocurrency without causing a big swing in its price.

High liquidity means lots of buyers and sellers, so you can make trades quickly and at prices that make sense.

On the flip side, low liquidity means fewer people are buying or selling, making it tricky to enter or exit a trade without messing with the price.

So, why does liquidity matter?

Imagine selling your bike in a ghost town versus a busy city. In the ghost town, it’s tough to find a buyer, and when you do, they might offer less because there’s not much demand.

But in the busy city, you’ve got loads of options and are likely to get a fair price because there are so many potential buyers.

Likewise, when trading cryptocurrencies, good liquidity means you can jump in and out of trades easily without worrying about drastically affecting the market price.

Why Liquidity is Important for Crypto Traders

Let’s talk about why liquidity is a big deal when you’re into trading cryptocurrencies:

- Smooth Execution of Trades: When there’s high liquidity, you can buy and sell cryptocurrencies quickly and at the price you expect. No waiting around for someone to come along and take the other side of your trade.

- Avoiding Price Slippage: Ever tried to sell something, and right when you hit ‘sell,’ the price drops? That’s price slippage, and it happens when there’s low liquidity. With high liquidity, you’re less likely to experience this because there are plenty of buyers and sellers to match your trade without causing big price swings.

- Ensuring Fair Market Prices: Liquidity keeps the market honest. When there are lots of participants, prices tend to reflect the true value of the crypto. But in illiquid markets, prices can be easily manipulated by a few players, leaving you with the short end of the stick.

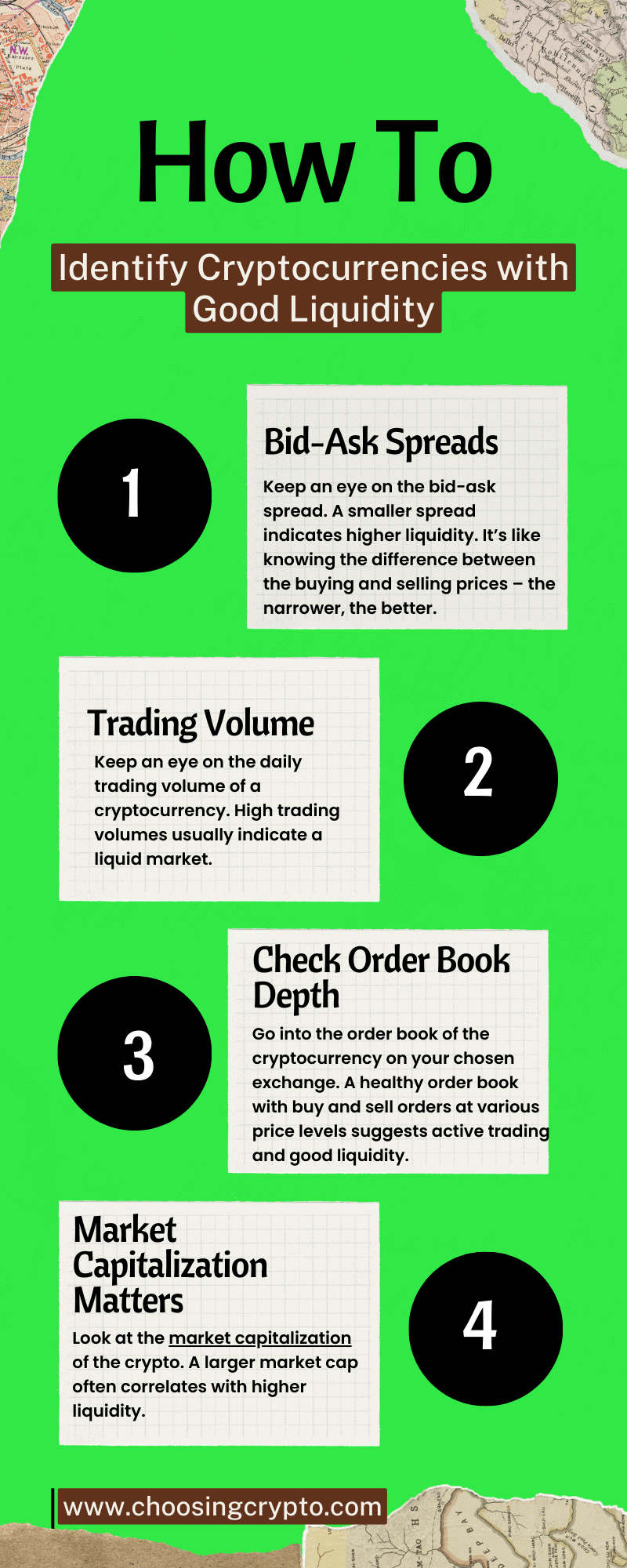

How to Identify Cryptocurrencies with Good Liquidity

As a beginner, it’s crucial to know how to spot cryptocurrencies with good liquidity to ensure a smoother trading experience.

- Bid-Ask Spreads: Keep an eye on the bid-ask spread. A smaller spread indicates higher liquidity. It’s like knowing the difference between the buying and selling prices – the narrower, the better.

- Trading Volume: Keep an eye on the daily trading volume of a cryptocurrency. High trading volumes usually indicate a liquid market.

- Check Order Book Depth: Go into the order book of the cryptocurrency on your chosen exchange. A healthy order book with buy and sell orders at various price levels suggests active trading and good liquidity.

- Market Capitalization Matters: Look at the market capitalization of the crypto. A larger market cap often correlates with higher liquidity.

Strategies for Dealing with Liquidity Issues in Crypto Trading

As a beginner, it’s important to equip yourself with strategies to reduce the risks associated with trading in less liquid markets.

Let’s go into some tactics to help you navigate these challenges effectively:

- Choose Popular Cryptocurrencies: Pick cryptocurrencies that lots of people use and trade often, like Bitcoin and Ethereum. These popular ones are more likely to be traded a lot, which means it’s easier for you to buy and sell them when you want to.

- Explore High-Volume Exchanges: Stick with exchanges that have been around for a while and where lots of trading happens. Places like Binance, Bybit, and Gate.io are good choices. They’re known for being easy to use and having plenty of people buying and selling, which keeps things lively.

- Check Trading Pairs Liquidity: Before you go into trading a specific trading pair of cryptocurrencies, check how easy it is to trade them. Focus on pairs with high liquidity to avoid problems with low trading activity. Pairs with lots of trading going on make it easier to buy and sell at good prices.

- Monitor Volume and Order Books: Keep an eye on the trading volume and order books of your chosen cryptocurrencies. Many platforms show this information, letting you see recent activity and current orders to buy or sell. A healthy volume and well-populated order book are signs of liquidity

- Utilize Stop-Loss and Take-Profit Orders: Make use of stop-loss and take-profit orders to manage your trades well. These orders help you set levels for selling or buying, so you can get out of trades without being caught out by sudden price swings.

Additional Resources:

Excited to learn more about Bitcoin and cryptocurrencies? We’ve got some awesome resources below to help you out.

- The Importance of Backtesting in Crypto Trading

- How to Start Trading Crypto as a Beginner

- The Importance of Technical Analysis in Crypto Trading

- Best Tools for Crypto Trading

- The Importance of Risk Management in Crypto Trading

- The Role of Fundamental Analysis in Crypto Trading

And guess what? We’re also on Instagram and Twitter(X). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is intended for informational purposes only and should not be solely relied upon for making investment decisions. It does not constitute financial, tax, legal, or accounting advice. Additionally, I strongly recommend that you only invest in cryptocurrency an amount you are comfortable with potentially losing temporarily.

Read Also: How to Avoid Losses in Crypto Trading