You’ve probably heard the term “burning coins” a few times, but what does burning coins mean in crypto, and why should you even care?

If you’re scratching your head, wondering what on earth this mysterious practice entails, fear not! You’re in the right place.

In this blog post, we’re going to dive into what burning coins means in crypto, why it happens, and how it all works.

So, whether you’re a seasoned crypto trader or just a curious investor trying to figure things out, get ready for a journey into the heart of crypto burning.

We’ll unravel its secrets and shine a light on the potential benefits.

Ready?

IMPORTANT: I've selected some really great blog posts that I think you'll absolutely love. They're waiting for you right at the bottom of this post. Don't forget to give them a read!What Does Burning Coins Mean in Crypto?

In simple words, burning coins means purposely and permanently removing a portion of a cryptocurrency’s coins from circulation.

Let’s say you have a favorite crypto token, we’ll call it “XYZ Coin.”

Now, burning coins doesn’t involve setting them on fire or watching them disappear in smoke. Instead, it’s like taking a certain number of XYZ Coins out of circulation forever.

Think of it as reducing the total number of XYZ Coins that exist.

This intentional act of reducing supply can have interesting effects on the value and dynamics of the cryptocurrency.

When coins are burned, they’re usually sent to an address where they can never be accessed again.

Why Do Cryptocurrencies Burn Coins?

Cryptocurrencies don’t just burn coins for the fun of it.

Let’s dig into why burning coins is a deliberate move in the crypto world.

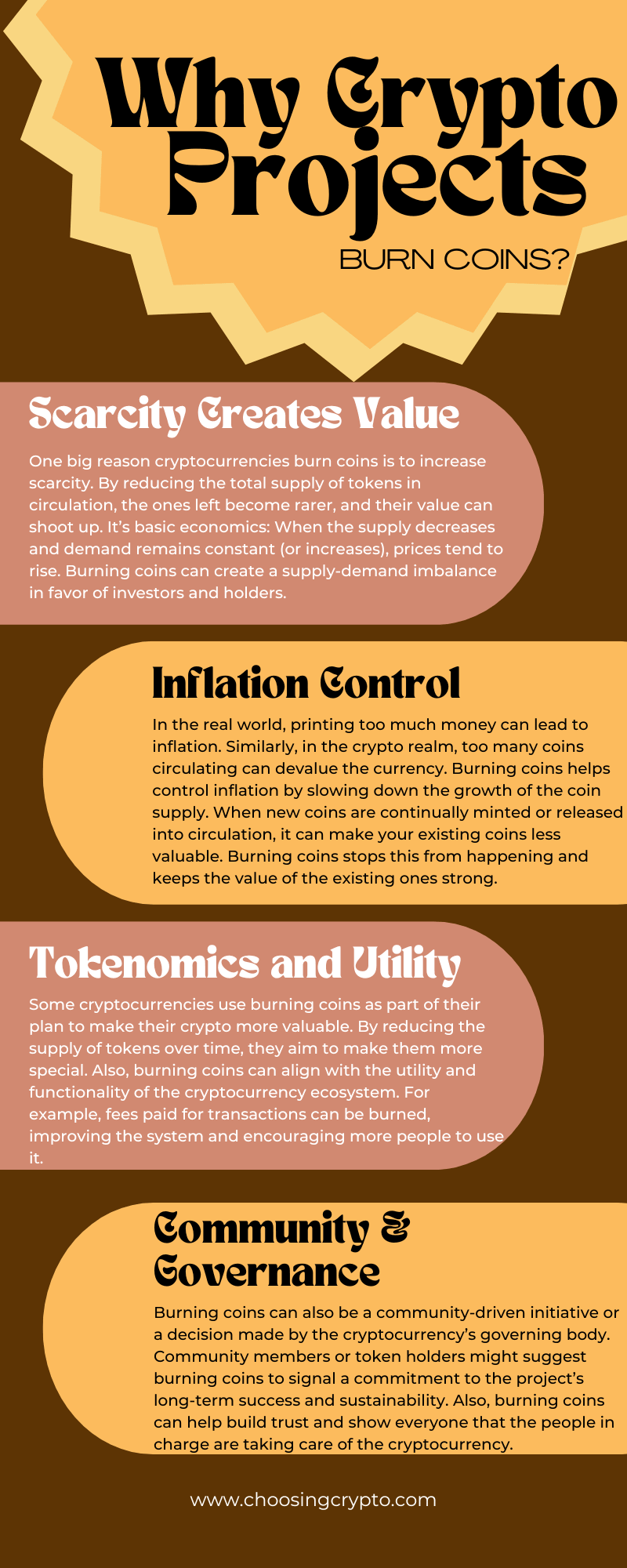

- Scarcity Creates Value: One big reason cryptocurrencies burn coins is to increase scarcity. By reducing the total supply of tokens in circulation, the ones left become rarer, and their value can shoot up. It’s basic economics: When the supply decreases and demand remains constant (or increases), prices tend to rise. Burning coins can create a supply-demand imbalance in favor of investors and holders.

- Inflation Control: In the real world, printing too much money can lead to inflation. Similarly, in the crypto realm, too many coins circulating can devalue the currency. Burning coins helps control inflation by slowing down the growth of the coin supply. When new coins are continually minted or released into circulation, it can make your existing coins less valuable. Burning coins stops this from happening and keeps the value of the existing ones strong.

- Tokenomics and Utility: Some cryptocurrencies use burning coins as part of their plan to make their crypto more valuable. By reducing the supply of tokens over time, they aim to make them more special. Also, burning coins can align with the utility and functionality of the cryptocurrency ecosystem. For example, fees paid for transactions can be burned, improving the system and encouraging more people to use it.

- Community and Governance: Burning coins can also be a community-driven initiative or a decision made by the cryptocurrency’s governing body. Community members or token holders might suggest burning coins to signal a commitment to the project’s long-term success and sustainability. Also, burning coins can help build trust and show everyone that the people in charge are taking care of the cryptocurrency.

How Burning Coins Happens

Now that we understand the reason behind it, let’s explore how cryptocurrencies go about burning their coins.

It’s not like they just throw them into a virtual bonfire.

1. Proof of Burn (PoB):

One of the main ways coins get burned is through something called Proof of Burn. Here’s how it works: participants send their coins to a specific address, essentially ‘burning’ them. In return, they get a reward.

2. Token Buybacks and Burns:

Some projects take a more direct approach. They buy back their coins from the market, which reduces the number of coins in circulation. Once they repurchase the coins, they often remove them permanently from circulation by sending them to an address where they can’t be accessed.

3. Coin Destruction Events:

Every now and then, projects organize special events or mechanisms where coins are intentionally destroyed. These events might be tied to milestones, achievements, or even community initiatives. It’s a way for projects to engage with their community while also managing their token supply.

Additional Resources:

Excited to learn more about Bitcoin and cryptocurrencies? We’ve got some awesome resources below to help you out.

- What is a Private Key in Crypto?

- 20 Things You Should Never Do as a Crypto Investor/Trader

- What are Trading Pairs in Cryptocurrency

- Top 7 Blockchain Misconceptions to Stop Believing

- What is the Difference Between SegWit and Legacy Bitcoin Addresses

And guess what? We’re also on Instagram and Twitter(X). Join us there for even more fun and useful content!

DISCLAIMER:

The information provided here is intended for informational purposes only and should not be solely relied upon for making investment decisions. It does not constitute financial, tax, legal, or accounting advice. Additionally, I strongly recommend that you only invest in cryptocurrency an amount you are comfortable with potentially losing temporarily.

Read Also: What is a Crypto Whitepaper